As the corporate strikes to generate revenues exterior meals supply, the proportion is beginning to shift. It’s now banking on companies like Blinkit and Hyperpure to energy its progress

(Images: Bandeep Singh)

(From left) Albinder Dhindsa, Founder & CEO, Blinkit; Deepinder Goyal, Co-founder & CEO, Zomato; Akshant Goyal, CFO, Zomato; and Rakesh Ranjan, CEO (Meals Supply), Zomato

Deepinder Goyal was able to put all the things on the road. It was a blistering Might afternoon in 2022, and the Zomato Co-founder & CEO was engrossed in discussions a couple of potential buyout of fast commerce participant Blinkit with CFO Akshant Goyal on the Co-founder’s farmhouse in Delhi. If the deal went by, the Gurugram-headquartered firm would acquire a foothold within the rising fast commerce house. The hitch was the asking worth.

“Akshant and I knew traders wouldn’t prefer it, however we determined to go for it. Our logic was if another person did it three years later, it might have harm since we had the cash however succumbed to investor stress,” says 41-year-old Goyal, an IIT Delhi alumnus. The duo thought that the worst that might occur can be that they’d get fired. However it made sense to go all in. “It was a paradoxical state of affairs since we might see the chance however didn’t need individuals to know because the competitors was larger than us,” says Goyal. What sophisticated issues additional was that the Zomato inventory was down by a 3rd since its itemizing in July 2021. “Our necks have been on the road, and we have been doing this proper in the course of a downturn,” says Akshant, 40, an IIM Bangalore alumnus, who has been with Zomato for practically seven years. The all-stock deal was sealed in June 2022 at $569 million (then Rs 4,447 crore).

Deepinder Goyal

Co-founder and CEO

Zomato

‘Blinkit shall be bigger than Zomato’: Learn the unique interview with Deepinder Goyal the place he breaks down the meals supply main’s future progress technique

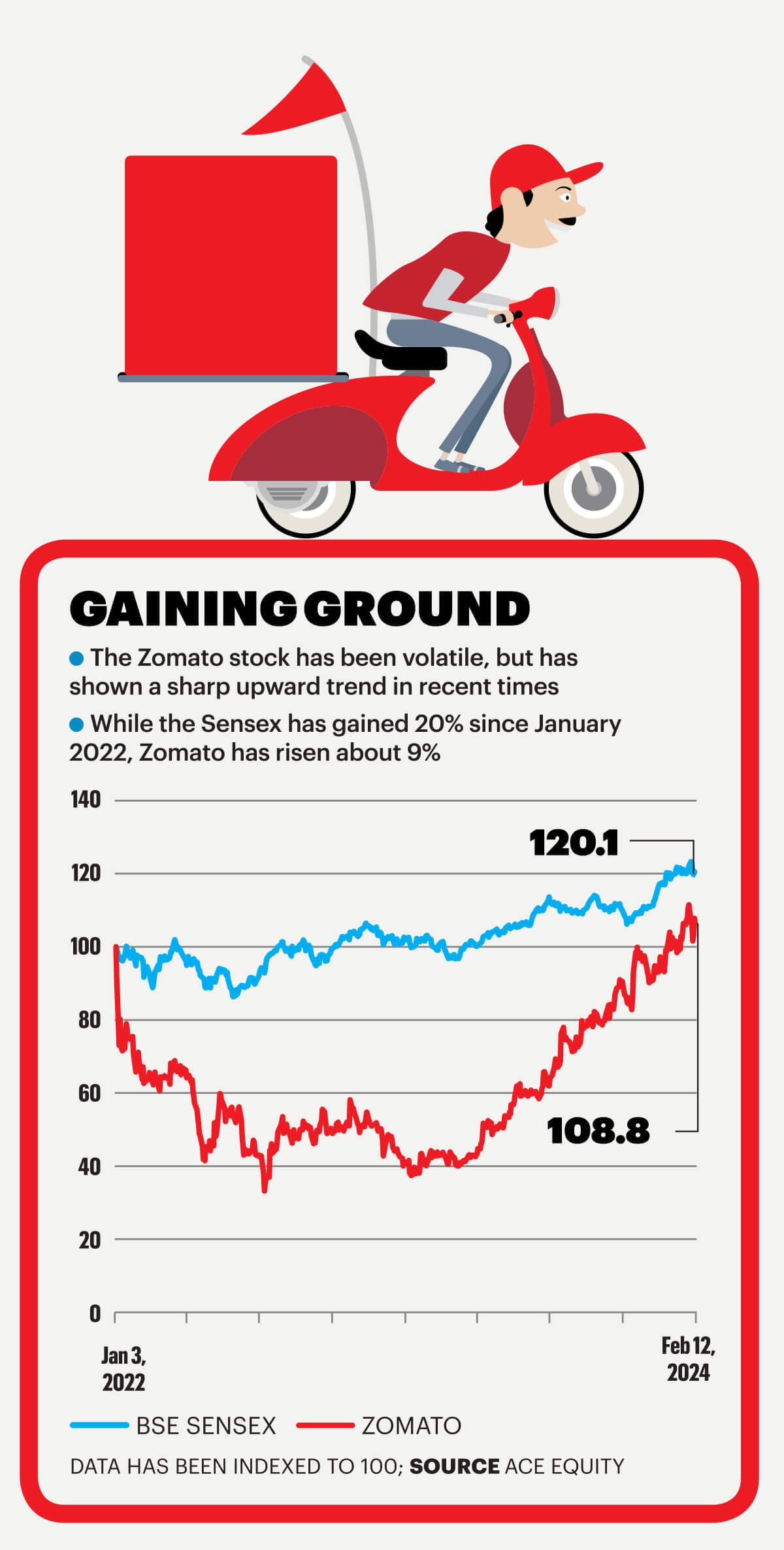

It has been one and a half years since. Each have retained their jobs; Zomato has posted three consecutive quarters of revenue (for Q3FY24, it posted web revenue of Rs 138 crore and complete revenue of Rs 3,507 crore); and traders are loving the inventory (it has gained greater than 30% since its itemizing). And, the new-look Zomato is increasing past its core on-line meals supply house, banking on companies like Blinkit and Hyperpure (a B2B platform for kitchen provides).

Bringing it collectively

Client insights energy Zomato’s progress. Per the corporate, it has a buyer base of 30-40 million throughout its companies. The administration says sound information of how clients assume results in a proper to win. “That information is intangible. It isn’t about synergy-first, however slightly being in several companies and constructing that frequent thread,” says Akshant. That perception got here in 2021 when there have been many 10-minute supply companies globally. Whereas the chance for fast commerce when it comes to scale was clear, the hitch was the restricted share of organised retail in India. “Shopping for behaviour is completely different right here since we don’t inventory however purchase every day. The idea got here from the West however was extra relevant right here,” he explains. So, the service needed to be reimagined.

Albinder Dhindsa

Founder & CEO

Blinkit

When Blinkit (often known as Grofers in its earlier kind) was purchased, it was dropping Rs 150 on every order. Promoting at a reduction introduced in demand, however a choice was made to cost for supply. Insights from the meals supply enterprise helped: 4 years in the past, Zomato was dropping Rs 120 on an order with a ticket dimension of Rs 300. Regardless of charging for supply, demand sustained and so did the shopper base; it now makes a revenue of Rs 10 per order. For Blinkit, information confirmed 100 new clients stayed again after three to 4 months and that was higher than Zomato—plus the order magnitude was 2x and the three-month retention was at 45% in comparison with 20-25% for meals supply. This led the administration to open extra darkish shops—a big facility that homes items used to meet on-line orders. Whereas the preliminary expectation was 1,200 orders per day, the quantity is within the vary of three,500-4,000 now, and they’re serviced by a community of darkish shops which might be replenished three to 4 occasions every day.

Greater volumes meant the shops might be redesigned, and slowly, the monetary returns started trying higher. “You must sweat the asset utterly since there’s bodily infrastructure. In meals supply, eating places pay the mounted prices,” says the CFO. That has paid off and the loss per order is right down to Rs 10-15.

In accordance with Albinder Dhindsa, Founder & CEO of Blinkit (he based on-line grocery supply service Grofers with Saurabh Kumar in 2013), fast commerce was considered way back to 2015, however the backend proved to be a difficulty. And when it emerged, it was not completely deliberate. “We opened shops through the pandemic because the provide chain had collapsed. To beat that, we disaggregated the services and as an alternative of 1 giant warehouse, we needed to go for smaller ones,” he recollects. Now, there was a possibility to ship sooner with a really environment friendly provide chain. “Stock should transfer quick and in the event you sweat the asset and improve the width of merchandise, the variety of locations the place you get working leverage (proportion of mounted prices to total prices) takes off. Fast commerce (other than Blinkit, there’s Swiggy Instamart and Zepto) could provide you with decrease income per merchandise, nevertheless it additionally strikes rapidly and assortment between shops should be completely different,” says Dhindsa, 41. When it comes to a strategic match, Zomato understood areas resembling how a lot to cost and the service parameters, whereas Blinkit had grasped the nuances of manufacturers, other than sourcing, warehousing, and replenishment.

Akshant Goyal

CFO

Zomato

The fast mantra

The ten-minute supply idea was initially to deal with pressing wants like Band-Help. Now, moreover groceries and family items, it additionally affords issues like printouts, passport pictures and even kurtas! “Plenty of it comes right down to prioritisation and the end result of consumers telling us what they need,” says Dhindsa. Blinkit is extra commerce and fewer about providers, provides Akshant. “The product assortment is essential and meaning we could not promote a cellular [phone] however will supply a cellular charger.”

The thought of fast commerce is straightforward, however execution is the important thing. And execution is oft repeated when Zomato is mentioned. Sanjeev Bikhchandani, Founder & Govt Vice Chairman of Data Edge, the holding firm of jobs portal Naukri.com—the primary investor in Zomato—picks execution as a differentiator for the Goyal-led firm. “It’s also true within the case of Blinkit and it’s clear that there’s a superb understanding of supply networks,” says Bikhchandani. Blinkit was initially a mannequin based mostly on same-day supply earlier than transferring to the 10-minute idea. “It managed to reorient the enterprise and the subsequent part for Blinkit shall be about scaling up. Execution for Zomato and its companies will stay essential, and so they should proceed to do this effectively.”

Bikhchandani recollects that when he invested in Zomato in 2010, what clinched it was Goyal’s down-to-earth method with readability on each the product and the shopper. “We put in a small sum of money initially (Rs 4.5 crore) and went solo for the primary 4 rounds earlier than Peak XV (then Sequoia) got here in. For the primary 10 years, Zomato did solely restaurant itemizing, and credit score should be given to [them for] getting it proper on meals supply (they ventured into this in 2018) after coming from behind.”

This flexibility of technique is one other of Zomato’s strengths. Ok.S. Narayanan, an impartial meals advisor, additionally mentions the way it pivoted to meals supply. “They’ve efficiently constructed their major enterprise round it and are one of many two gamers current nationally (Swiggy is the opposite one),” he says. With a complicated information analytics platform, there’s a higher understanding of buyer preferences. “In consequence, they introduced in Hyperpure as a platform to help eating places of their meals and non-food purchases. Because the meals providers sector will get extra organised, the rising enterprise alternative is what Hyperpure is trying to fulfil,” he says. In developed markets, the likes of Sysco and US Meals function with scale on this house. After all, a bigger Zomato with a number of companies offers it the power to barter tougher. “With Blinkit and Hyperpure, they need to have higher phrases of commerce with their provider companions, utilise supply networks in additional concentrated geographies and derive extra effectivity from the darkish shops,” says Narayanan.

Meals supply and extra

Coming again to meals supply, it has been a troublesome enterprise in the perfect of occasions. Over the previous 15 years, the likes of Simply Eat, Tasty Khana and TinyOwl shut store, whereas Zomato acquired Uber Eats and Swiggy wolfed up Scootsy. Rakesh Ranjan, CEO (Meals Supply) at Zomato, believes the subsequent frontier will come from exterior the highest 15-20 cities, which as we speak usher in 50-60% of the enterprise. “The 280 cities within the lengthy tail (Zomato operates in 685 cities in all) give me one other 10-12%,” he says. On a current go to to Lucknow, as an illustration, he met a restaurant proprietor who clocks revenues of round Rs 18 lakh per thirty days by his cloud kitchen. “In Delhi, doing Rs 10-12 lakh [per month] is wholesome. Our high three or 4 cities have grown by 30-40% every year and it’s clear that the center set will now take off,” the 39-year-old provides.

Rakesh Ranjan

CEO (Meals Supply)

Zomato

Going by analysis studies, Zomato has a 55% market share and leads Swiggy at 45%. The latter remains to be within the purple—for FY23, on a consolidated foundation, revenue stood at Rs 8,265 crore whereas the web loss was at Rs 4,179 crore; the meals supply enterprise turned Ebitda constructive. The house is successfully a duopoly. Ranjan says there aren’t too many identifiable niches in meals supply, and the differentiator is order or buyer expertise. The rub for many clients is the hidden or incremental expenses. For example, within the US, for a $15 pizza, you find yourself paying upwards of $40 by the point it’s delivered. As an answer, Zomato Gold, that provides free deliveries, was relaunched in India in January 2023 (with an introductory worth of Rs 149 for 3 months). “Clients don’t just like the friction of supply expenses. From a enterprise viewpoint, it was a troublesome choice, although we’ve got seen a spike so as frequency by 2-3x,” says Ranjan. Although this impacted income, he says Gold is “margin dilutive however not margin unfavourable”. Up to now, Gold was a dining-in property the place reductions have been supplied at sure eating places. The perception was that clients wished a 2.5-3x return on funding. So, the quantity saved with Gold is seen on the app. It appears to be working. He says 40% of the gross order worth as we speak is on account of Gold clients.

“Have a look at the variety of gamers in meals supply who’ve come and gone. There are simply two left as we speak and even Dunzo with Reliance’s backing has not discovered it straightforward,” says Vinit Bolinjkar, Head (Analysis) at Ventura Securities. Zomato, with a conflict chest of Rs 8,000-10,000 crore, he feels, can take a look at extra acquisitions. “There are huge adjacencies it will probably transfer into. The net pharmacy enterprise, establishing its personal product label or making a kitchen for its personal meals service are low-hanging fruits,” he provides. One massive benefit is its entry to client information. “With that, pursuing any alternative is feasible.”

The current hike in take fee (the fee that Zomato expenses from eating places for an order) through the New Yr noticed little impression on the enterprise. “Demand was large, and volumes took off. The sport is actually a couple of gradual improve in enterprise,” says Bolinjkar. After the buyout, Blinkit has scaled up and time has gone into constructing efficiencies, he says. “It’s now clearly structured for progress.” Zomato’s current forays into reside leisure and getting the nod to function a web-based funds aggregator enterprise might additionally strengthen the general client piece, say specialists.

What Zomato could not have is a really compelling story concerning the origin of its identify. Earlier referred to as Foodiebay, somebody alerted Goyal of a possible challenge because the final 4 letters might be mistaken for eBay. “We lastly zeroed in on Zomato after identify turbines threw it up,” he says. Possibly not that fascinating a narrative, however clients and traders definitely appear , particularly as Zomato seems to get it proper on worth and comfort.

x

UI Developer : Pankaj Negi

Inventive Producer : Raj Verma

Movies : Mohsin Shaikh

Images: Bandeep Singh

[ad_2]