[ad_1]

Investor efforts to guage carbon emissions, decarbonization plans, and local weather dangers via ESG (environmental, social, and governance) score schemes have merely produced what some teachers name “mixture confusion.” And firms have confronted few penalties for failing to obviously disclose emissions and even meet their very own requirements.

All of which is to say {that a} new set of SEC carbon accounting and reporting guidelines that largely replicate the issues with voluntary company motion, by failing to require constant and actionable disclosures, isn’t going to drive the adjustments we want, on the velocity we want.

Firms, traders, and the general public require guidelines that drive adjustments inside firms and that may be correctly assessed from outdoors them.

This technique wants to trace the principle sources of company emissions and incentivize firms to make actual investments in efforts to realize deep emissions cuts, each throughout the firm and throughout its provide chain.

The excellent news is that though the foundations in place are restricted and flawed, regulators, areas, and corporations themselves can construct upon them to maneuver towards extra significant local weather motion.

The neatest corporations and traders are already going past the SEC laws. They’re growing higher methods to trace the drivers and prices of carbon emissions, and taking concrete steps to deal with them: decreasing gas use, constructing energy-efficient infrastructure, and adopting lower-carbon supplies, merchandise, and processes.

It’s now simply good enterprise to search for carbon reductions that really lower your expenses.

The SEC has taken an essential, albeit flawed, first step in nudging our monetary legal guidelines to acknowledge local weather impacts and dangers. However regulators and firms want to choose up the tempo from right here, making certain that they’re offering a transparent image of how shortly or slowly firms are transferring as they take the steps and make the investments wanted to thrive in a transitioning financial system—and on an more and more dangerous planet.

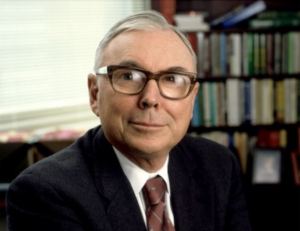

Dara O’Rourke is an affiliate professor and co-director of the grasp of local weather options program on the College of California, Berkeley.

[ad_2]