The Indian mutual fund trade’s belongings have grown manifold previously couple of years, attracting a clutch of aggressive new entrants. Will the dream run proceed? And the way will the gamers co-exist?

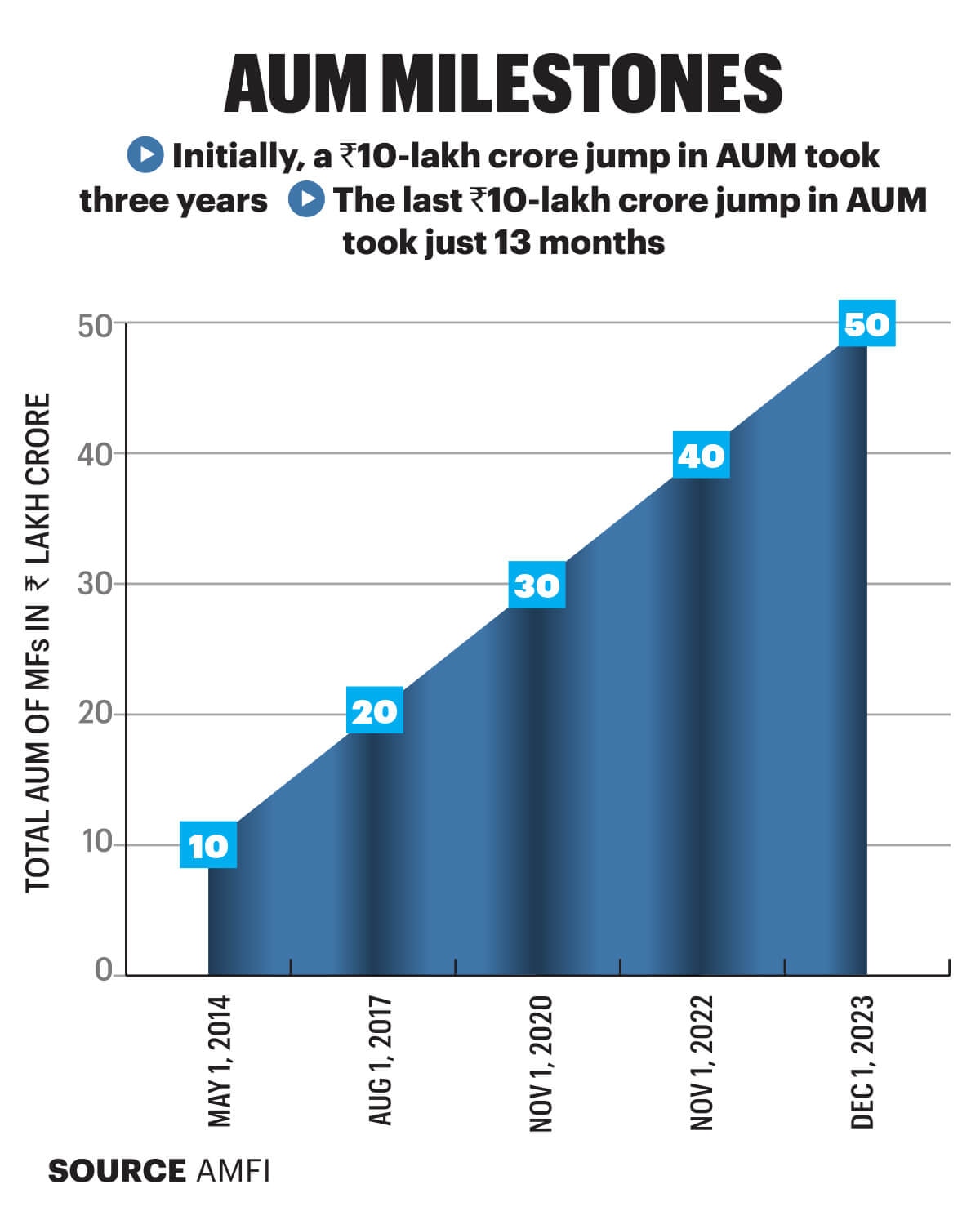

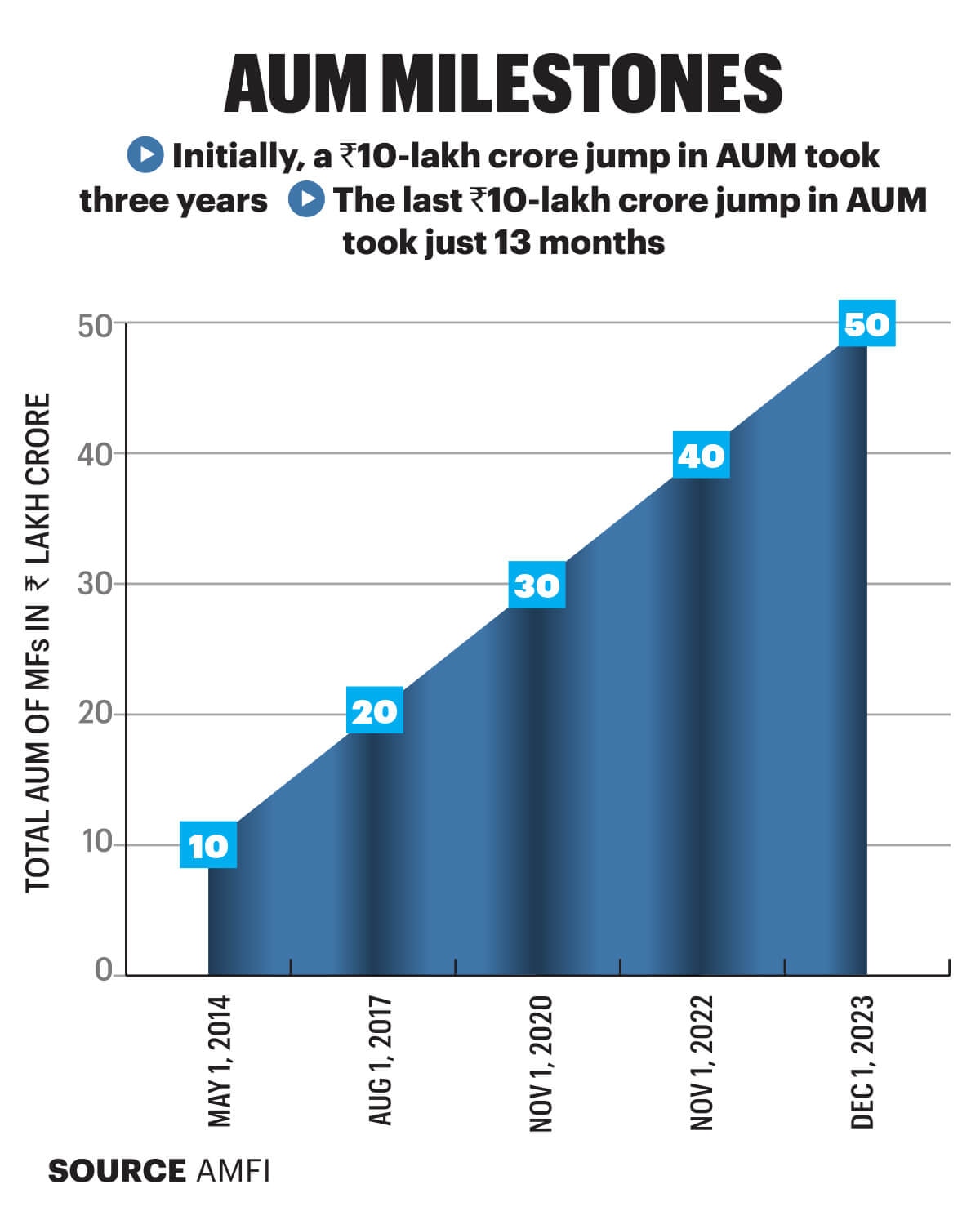

The Indian mutual fund trade positively ended 2023 on a excessive. The trade’s whole belongings beneath administration (AUM) breached the Rs 50-lakh crore mark for the primary time.

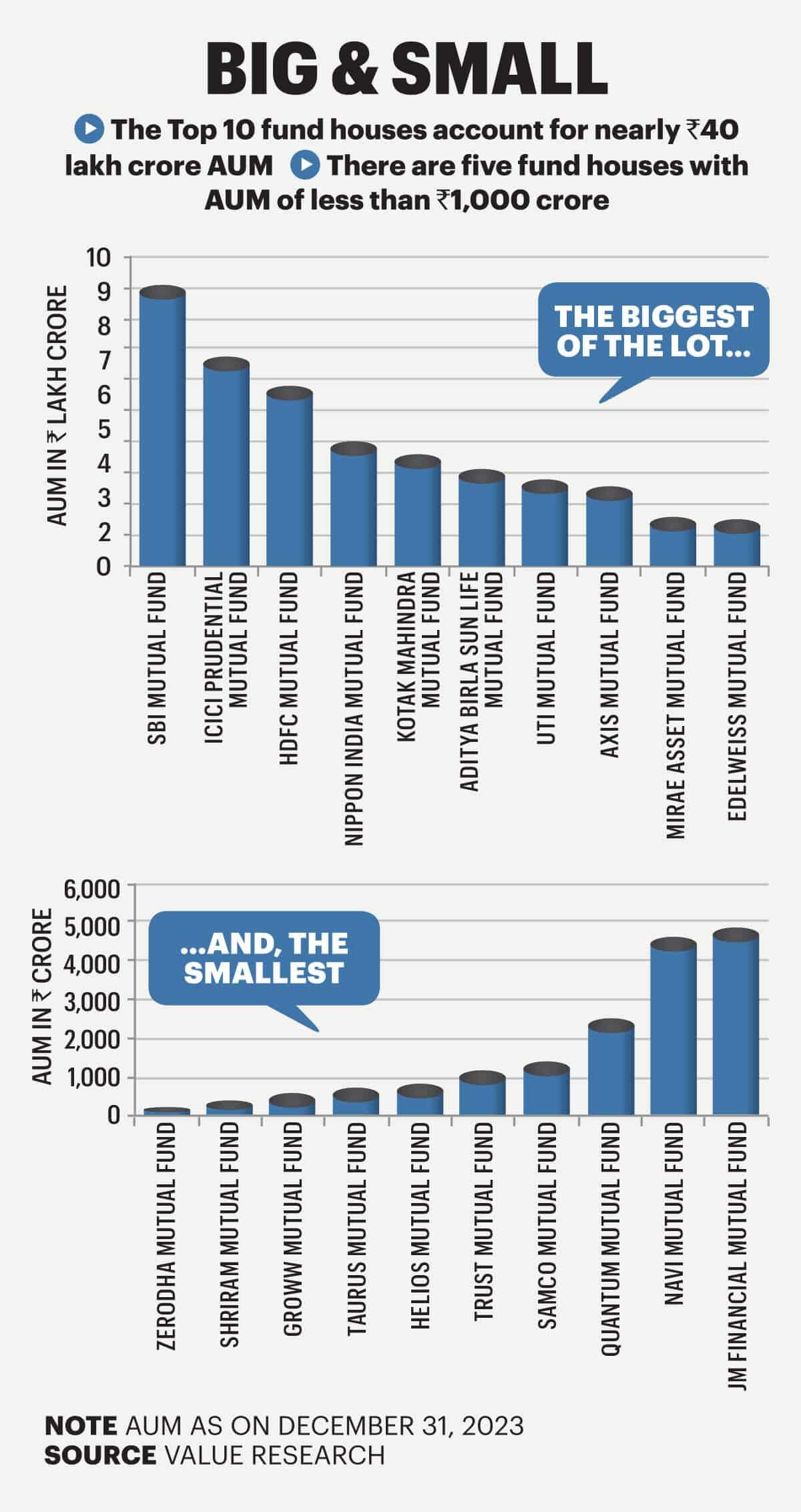

This was little doubt an enormous milestone, however what cheered the trade much more was the time it had taken to succeed in this milestone. The trade’s AUM first crossed the Rs 10-lakh crore mark approach again in Could 2014. It doubled three years later, in August 2017. Three years later, in November 2020, it touched Rs 30 lakh crore. After which the gears shifted, and the following Rs 10 lakh crore was added in simply two years, adopted by the final Rs 10 lakh crore in a mere 13 months. Put one other approach, the mutual fund AUM swelled by Rs 40 lakh crore in a little bit beneath 9 years.

Because of this spurt in progress, a big part of trade contributors imagine that the tempo of progress will speed up additional and the trade’s AUM may greater than double in 4 to 5 years.

“ Distribution and customer support: That’s the key for newer gamers. Innovation in distribution is required by way of easy methods to attain newer traders ”

Vishal Jain

CEO

Zerodha Mutual Fund

What’s the rationale for this optimism, one might marvel. It’s easy: The latest feats of the trade have been achieved with just a bit over 40 million traders—an enormous bounce from round 19 million in December 2018. Now, examine that with India’s inhabitants of 1.4 billion, and you’ll see why trade officers are bullish on the expansion potential right here.

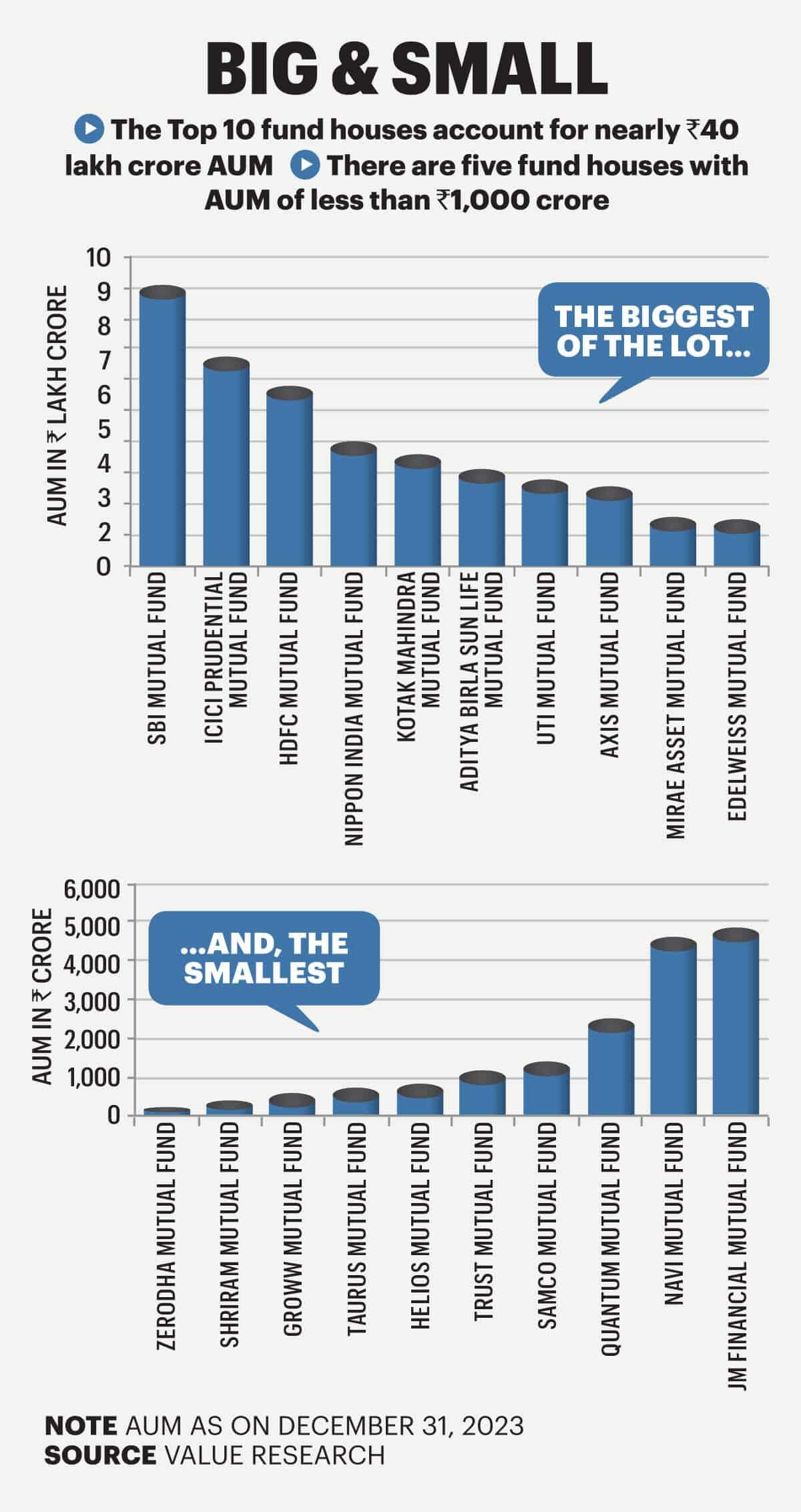

It’s this massive alternative that has attracted a slew of recent gamers into this house, sparking a paradigm shift hitherto not seen till a few years in the past. They embody numerous new-age expertise majors like low cost dealer Zerodha, PhonePe, Navi, Groww, and Samco. Moreover, many older companies from the BFSI house are additionally making an entry right here.

And there’s maybe no higher proof of the curiosity right here than the lately introduced three way partnership between Jio Monetary Providers and BlackRock Monetary Administration Inc., which is awaiting regulatory approval.

Regardless of these big-bang entries into this house—the place the capital markets regulator Securities and Change Board of India (Sebi) intently displays each transfer of the fund supervisor and fund home—there are simply 45 fund homes or asset administration firms (AMCs). Of those, solely 14 fund homes boast an AUM in extra of Rs 1 lakh crore every. That is why trade insiders see quite a lot of room for progress.

hough the house might appear to have change into saturated for the informal observer, fund homes prefer to level out that the numbers are on a bigger scale in developed nations. “The Indian mutual fund trade has round 40–45 fund homes, however for those who take a look at the West, there are 200+ asset managers,” says Ruchi Pandey, CEO of Outdated Bridge Mutual Fund, which lately introduced its maiden fund launch.

In the course of the launch of the fund, Pandey stated that such is the dimensions of the general financial savings pool that any new entrant simply provides to the MF trigger. Certainly, as a result of mutual fund penetration is abysmal, to say the least, most fund homes need to each appeal to tens of millions of recent traders and, in flip, give a push to their very own companies and the trade’s total AUM progress.

“ The sum of money sitting on the sidelines to get invested or the general financial savings pool has modified a lot, I really feel any new entrant is simply performing as a constructive to the trigger ”

Ruchi Pandey

CEO

Outdated Bridge Mutual Fund

“The primary goal we wish to work in direction of is monetary inclusion as a result of we expect that penetration degree at the moment remains to be restricted with simply 40 million distinctive PAN folios in a inhabitants of 1.4 billion,” says Vishal Jain, CEO of Zerodha Mutual Fund.

He says the query now could be easy methods to get the following 100 million traders to place their cash into mutual fund merchandise. “We’re coming to the market with that focus. Our perception is that you could hit the quantity for those who begin every of the small issues and begin fixing that,” provides Jain, whose fund home has adopted a totally passive method.

Passive funds search to copy the benchmark index, and there’s no lively shopping for or promoting by a fund supervisor. Passive funds sometimes have a decrease price construction in contrast with lively ones.

One other information level that trade gamers love to focus on is the overall AUM as a share of the nation’s gross home product, or GDP. At present ranges, the quantity is pegged round 35%—which is considerably decrease when in comparison with a few of the different main markets just like the US, the place it hovers round 100%. By the way, the Indian tally could be far decrease if solely the fairness part was thought-about.

Business gamers anticipate the variety of distinctive mf traders to rise to 100-120 million by fy30, from round 40 million at current

As of December 31, 2023, the overall AUM of the MF trade was Rs 50.78 lakh crore, and the share of debt belongings was Rs 12.91 lakh crore, per trade physique Affiliation of Mutual Funds in India (AMFI).

“If solely fairness AUM is taken into account, the AUM-to-GDP ratio will nonetheless be decrease. Within the US, the GDP to MF AUM is sort of equal,” says A. Balasubramanian, MD & CEO of Aditya Birla Solar Life Mutual Fund, one of many largest fund homes within the nation by way of whole belongings.

He feels many extra fund homes will enter the market and broaden. “There may be big scope for extra fund homes. Should you go deeper into the nation, folks nonetheless favor fastened deposits and native financial savings. That can change considerably,” says Balasubramanian.

On this backdrop, the tech-native new entrants are extensively anticipated to onboard extra traders because of their progressive method to distribution. Within the course of, these companies have introduced in huge innovation each by way of product and distribution, launching schemes with varied differentiated funding approaches.

“ I’d say for brand spanking new AMCs significantly it is extremely vital… having each differentiated merchandise and the help of distribution is vital ”

Ganesh Mohan

CEO

Bajaj Finserv Mutal Fund

With the inflow of newcomers into the MF house, there has additionally been a rush to supply differentiated merchandise. “We use expertise to distinguish as effectively. On this funding pushed trade with over 40 established gamers, any distinctive promoting level should give attention to funding methods,” says Ganesh Mohan, CEO of Bajaj Finserv Mutual Fund.

“I’d say for brand spanking new AMCs significantly it is extremely vital. Once you would not have a lot of a observe file on this enterprise, and you are attempting to construct scale and relevance, having each differentiated merchandise in addition to the help of distribution is vital to have the ability to construct the enterprise,” he provides. As a part of its personal set of differentiators, Bajaj Finserv has come out with an funding philosophy based mostly on InQuBe, the AMC’s proprietary framework that provides a layer of behavioural finance to the informational and quantitative edges.

“Distribution and customer support: That’s the key for newer gamers. Innovation in distribution is required by way of easy methods to attain newer traders,” says Jain of Zerodha MF.

“One of many the reason why quite a lot of new gamers have are available is due to the approaching of age of the digital ecosystem in India. That’s what is triggering digital or on-line platforms throughout the fintech house. The digital ecosystem based mostly on Aadhaar, or UPI, has helped onboard purchasers extra simply right now. I believe the youthful traders might be the primary to begin utilizing these platforms as a result of they’ve grown within the digital age,” he provides. By the way, trade estimates recommend that there are 1.2 billion web customers within the nation, 800 million e-commerce customers, 500 million OTT subscribers, and 300 million UPI customers.

However digital is just not the one approach forward, and an omnichannel method—a mixture of digital and old-school contact factors—may go greatest when coping with a various and diversified economic system like India.

“When everybody says digital has come and bodily will go, that isn’t true. You take a look at our buyer sample; digital is there, however we nonetheless go to brick-and-mortar outlets. Sure, percentages change,” says Pandey of Outdated Bridge MF.

The share will certainly change, and the technique that does the trick in a metro like Mumbai or Delhi might not be excellent for a Tier II or III city, however the market is clearly there, and with the correct differentiation, new gamers can co-exist with older ones which have a observe file, because the pie is just too massive.

There appears to be little doubt concerning the Indian MF trade’s big potential for progress. The present penetration degree or the variety of traders may be very low when in comparison with the variety of e-commerce customers and even these simply utilizing varied meals supply apps—it’s estimated to be round 280 million.

In actual fact, in a latest presentation, Bajaj Finserv MF highlighted that MF AUM surged by three to 4 instances in nations like Malaysia and Thailand when their respective GDPs doubled in 10–15 years.

By FY30, the variety of distinctive traders in MFs ought to get to round 100-120 million, and the AUM ought to be near Rs 130 lakh crore, says Mohan.

There appears to be unanimity amongst fund managers that the trick is to create a distinct segment based mostly on innovation in each product and distribution.

“New gamers will clearly take time to construct a observe file. In the end, the enterprise will develop solely for many who are deeply dedicated to rising it. Should you take a look at the opposite markets as effectively, whereas there are just a few massive gamers, there are numerous boutique companies as effectively. Within the mutual fund enterprise, your progress can be topic to your degree of dedication,” says Balasubramanian.

The market is ready. All that’s wanted now could be focus and dedication, getting the fundamentals proper, and sooner reasonably than later, the MF pie is sure to broaden. Within the pages that observe, we carry you varied facets of the mutual funds trade.

x

UI Developer : Pankaj Negi

Inventive Producer : Raj Verma

Movies : Mohsin Shaikh

[ad_2]