[ad_1]

Nonprofit hospitals are beneath rising scrutiny for skimping on charity care, relentlessly pursuing funds from low-income sufferers, and paying executives large multi-million-dollar salaries—all whereas incomes tax breaks totaling billions.

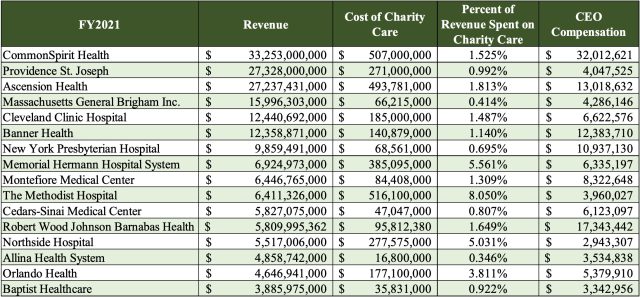

One such hospital system is RWJBarnabas Well being, a big nonprofit chain in New Jersey, whose CEO made a whopping $17 million in 2021, whereas the hospital system solely spent 1.65 % of its almost $6 billion in income on charity care.

Sen. Bernie Sanders (I-Vt.), chairman of the Senate Well being, Schooling, Labor, and Pensions (HELP) Committee, is gearing up for a showdown next week with the CEO of RWJBarnabas Well being, Mark Manigan. Nurses at one of many chain’s areas, Robert Wooden Johnson College Hospital, are on strike, saying that the ability has grow to be a harmful place to work because of insufficient staffing ranges.

“I stay up for listening to how [Manigan’s] well being care system might afford to spend over $17 million on CEO compensation in 2021 and the way his hospital might afford $87 million on touring nurses for the reason that strike started, however someway can’t afford to mandate secure staffing ratios to enhance the lives of sufferers and well being care employees,” Sanders mentioned in an announcement this week.

RWJBarnabas Well being is way from alone in having plump govt pay and slim charity care spending. A HELP committee staff report released earlier this month examined the monetary knowledge on 16 of the nation’s largest nonprofit, tax-exempt hospital methods. The methods collectively make greater than $3 billion in income every year, however in 2021, 12 of the 16 methods spent lower than 2 % of their income on charity care—although, as nonprofits, they earn federal, state, and native tax exemptions for offering charity care to low-income folks and different charitable neighborhood advantages. Of these 12 spending lower than 2 %, six of them spent lower than 1 %.

In the meantime, CEO compensation for the 16 methods averaged over $8 million, with a collective complete of over $140 million. By far, the most important earner was the CEO of CommonSpirit Well being, a large Catholic nonprofit system that runs 139 hospitals in 21 states. In 2021, CommonSpirit’s CEO made $32 million. In the identical yr, the system spent $507 million on charity care, or 1.5 % of its $33 billion income.

Along with failing to supply low-income sufferers with free or lower-cost care, among the well being methods ruthlessly sought cost, sending sufferers to assortment businesses, inserting liens on their property, and garnishing wages.

Allina Well being System, which runs nonprofit hospitals in Minnesota and western Wisconsin, denied offering medical care and blocked appointments for sufferers—even kids—if they’d excellent hospital payments. In 2021, Allina spent 0.3 % of its income on charity care whereas its CEO made $3.5 million. Solely after media consideration did the hospital system change its coverage.

The findings are significantly troubling given the hundreds of thousands of {dollars} that hospitals reap with their nonprofit standing. In 2020, the nation’s 2,978 nonprofit hospitals collectively acquired an estimated $28 billion in federal, state, and native tax advantages because of not paying these taxes, according to an analysis by the Kaiser Family Foundation. That works out to a mean of $9.4 million per hospital—and accounts for 44 % of nonprofit hospitals’ collective web earnings (income minus bills) for that yr.

The Senate employees report concluded by accusing the hospital methods of “worth gouging.”

“The disparities between the paltry quantities these hospitals are spending on charity care and their large revenues and extreme govt compensation demonstrates that they’re failing to dwell as much as their finish of the non-profit discount,” the report reads.

The American Hospital Association, meanwhile, blasted the report, saying it’s “completely off base and doesn’t absolutely account for the wide selection of neighborhood advantages that hospitals present.” The Affiliation pointed to its personal analysis, which urged that tax-exempt hospitals offered $129 billion in complete advantages to their communities in 2020.

[ad_2]