[ad_1]

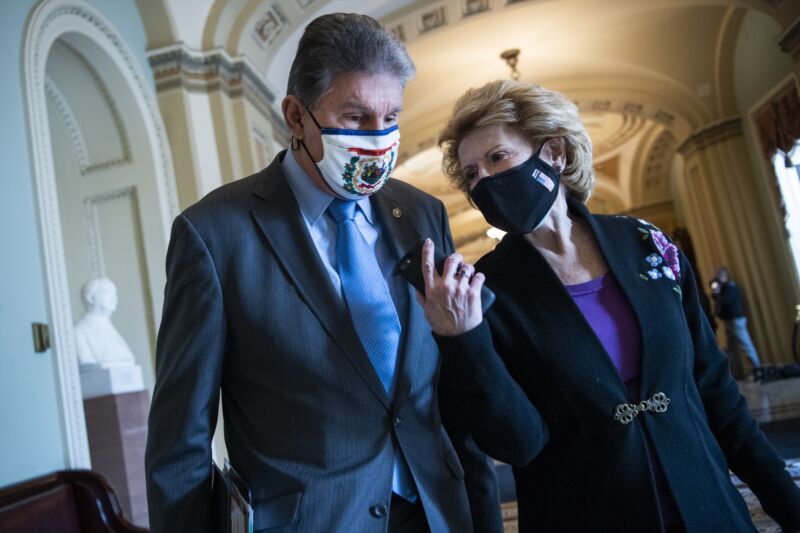

Tom Williams/CQ-Roll Name, Inc through Getty Pictures

The brand new and somewhat-complicated guidelines governing which vehicles do or do not qualify for the brand new clear car tax credit score seem like they may get tweaked somewhat within the close to future.

Earlier than, the tax credit score was linked to the battery-storage capability of a plug-in hybrid or battery-electric car. However the Inflation Discount Act modified that—now a range of conditions must be met, together with closing meeting in North America and an yearly growing proportion of domestically sourced minerals and parts inside that battery pack.

On the one hand, the home sourcing necessities are useful as a result of they’re stimulating the event of native battery mineral refining and manufacturing right here in the US, including well-paying jobs within the course of. However the brand new guidelines have additionally considerably lowered the variety of EVs that qualify.

For 2023, $3,750 of the clear car tax credit score is obtainable if 40 % of the essential minerals within the battery pack had been extracted or refined within the US, or a rustic with which we’ve a free commerce settlement. The opposite $3,750 is linked to the financial worth of the battery parts—for this 12 months, 50 % of that worth should come from parts manufactured or assembled within the US.

(N.B.—these guidelines do not apply to leased clear automobiles, many extra of that are eligible for the complete $7,500 tax credit score.)

To this point so good, however every year the required proportion of domestically extracted or refined essential minerals, and the share of worth manufactured or assembled within the US will increase by 10 %. That can seemingly make some now-qualifying clear automobiles ineligible from subsequent 12 months.

Certainly, in July Tesla started warning potential customers that whereas the Mannequin 3 is presently eligible for the complete $7,500 credit score, it’s prone to change for the more severe firstly of 2024.

Optimists say that these necessities had been put into the IRA by Sen. Joe Manchin (D-W.V.) with a view to develop our home battery business. Cynics could retort that Manchin has regularly and vociferously opposed any EV rebates and should merely have been attempting to make as many vehicles as attainable ineligible for so long as attainable.

Most lately, Manchin has been vocal about his want to see the US Treasury use “the strictest possible standards” in imposing the foundations, such that any EV with Chinese language-made batteries or minerals refined in China can be excluded. The IRS guidelines specify that batteries linked to “international entities of concern” are ineligible for the credit score, however as but has not printed guidelines on what it considers to be a “international entity of concern.” Given the shut hyperlinks between the Chinese language Communist Social gathering and China’s EV business, a broad brush might cowl a variety of manufacturers and automobiles.

However Manchin shouldn’t be the one US Senator with a canine on this combat. Sen. Debbie Stabenow (D-Mich.) told Bloomberg that “we’re in ongoing discussions” with the US Treasury and Division of Vitality and that “I definitely weighed in to precise assist for the issues of the automakers.”

The IRS steering on the way it will outline “international entities of concern” is due later this week, which ought to clear up simply how a lot Chinese language content material makes an EV ineligible for a tax credit score.

[ad_2]