[ad_1]

Unlock the Editor’s Digest free of charge

Roula Khalaf, Editor of the FT, selects her favorite tales on this weekly e-newsletter.

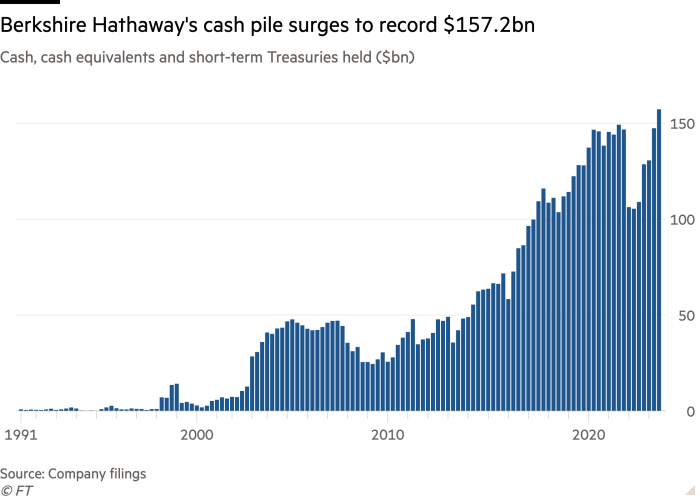

Berkshire Hathaway’s money pile surged to a report $157bn in 1 / 4 during which chief government Warren Buffett continued to promote stakes in publicly traded corporations, because the so-called Oracle of Omaha discovered a dearth of interesting investments.

The corporate bought greater than $5bn price of US and overseas shares within the third quarter, in response to outcomes launched on Saturday. The gross sales lifted Berkshire’s divestments of listed shares to almost $40bn over the previous yr.

Buyers should wait an extra two weeks earlier than they’ll see how Buffett adjusted Berkshire’s portfolio. However Saturday’s outcomes submitting indicated the corporate bought greater than 12mn Chevron shares earlier than it purchased Hess for $53bn in an all-stock deal final month.

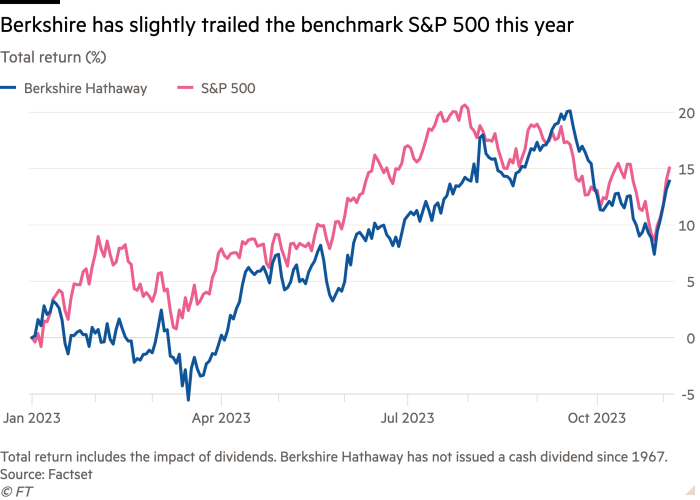

The worth of Berkshire’s portfolio of shares shrank to $319bn from $353bn on the finish of June, a decline fuelled by the slide in the broader stock market as traders got here to consider that the Federal Reserve would preserve rates of interest larger for longer.

That has weighed on the valuations of publicly traded corporations and prompted some portfolio managers to seek for higher returns in mounted earnings markets. The worth of Berkshire’s stake in Apple alone dropped by greater than $20bn, as shares of the iPhone maker fell 12 per cent within the three months to the top of September.

Buffett’s funding shifts are carefully scrutinised by fund managers and the broader public alike for clues as to the place the 93-year-old investor sees enticing returns.

He directed the proceeds from the inventory gross sales, in addition to the money flows Berkshire’s many companies generated, into money and Treasury payments. The corporate’s money pile surged through the quarter by almost $10bn to a report $157.2bn, a sum that offers it formidable firepower for acquisitions.

Berkshire has been one of many massive beneficiaries of rising US rates of interest, which have climbed above 5 per cent this yr. The corporate disclosed that the curiosity earnings it was incomes on its insurance coverage investments climbed to $1.7bn within the three-month interval, lifting the sum to $5.1bn over the previous 12 months. That eclipsed the overall curiosity Berkshire earned on its money reserves within the previous three years mixed.

“Charges are enticing right here and it looks like it creates a hurdle or disincentive to place money to work in the event you can earn 4 per-cent threat free,” mentioned Jim Shanahan, an analyst at Edward Jones. “I might suspect that the money steadiness most likely continues to creep larger from right here.”

Buffett disclosed that the corporate repurchased $1.1bn price of Berkshire inventory within the quarter, down from $1.4bn within the second quarter. Nevertheless, the submitting confirmed purchases had accelerated in August and once more in September, in an indication that the billionaire investor believed shares of the corporate have been undervalued.

The corporate’s working companies, which span the BNSF railroad, Geico insurer and plane components maker Precision Castparts, reported a 41 per cent rise in income to $10.8bn. The features have been fuelled by its insurance coverage unit, which reported robust underwriting income of $2.4bn, offsetting weak spot at BNSF and reserves for losses tied to wildfire litigation towards its utility.

Ajit Jain, a Berkshire vice-chair who oversees its insurance coverage operations, instructed shareholders on the annual assembly in Could that the corporate had wagered closely on the Florida insurance coverage market and had written insurance policies within the hurricane-prone state.

It was a dangerous wager that Jain estimated may price Berkshire as a lot as $15bn if the state was hit by highly effective storms. However this yr, the state skilled a comparatively tame season.

Berkshire on Saturday reported that vital disaster losses — particular person insurance coverage losses that high $150mn — had solely reached $590mn within the first 9 months of the yr. That determine is down from $3.9bn in the identical interval final yr, when Hurricane Ian pummelled Florida.

The corporate’s Geico auto-insurer, which had struggled to deal with payouts on claims for a lot of the previous two years, confirmed enchancment. The unit has shed greater than 2mn policyholders this yr and slashed its promoting finances because it focuses on insurance coverage contracts it believes it might probably revenue from.

Outdoors of insurance coverage, Berkshire’s earnings underscored the uneven financial development that has confounded economists and far of the investing world. Gross sales slid on the attire and shoemakers it owns, which incorporates Fruit of the Loom, and its actual estate-related companies which continued to battle with decrease demand given excessive mortgage charges. BNSF additionally reported decrease rail cargo volumes.

Nevertheless, the corporate’s fractional personal jet possession enterprise NetJets reported a bounce in demand from rich purchasers, and its auto dealerships reported rising gross sales of recent autos.

“There may be an rising theme this earnings season that the lower-end client is beginning to present some cracks, that they could not have a lot extra liquidity and that they’re feeling the stress from larger prices,” Shanahan added.

Berkshire additionally detailed the continued fallout from the 2020 and 2022 wildfires that unfold via California and Oregon. The corporate took a $1.4bn cost within the interval for payouts its utility will most likely need to make to people who misplaced their houses within the blaze, lifting the cumulative expenses it has taken for the wildfires to $2.4bn.

Berkshire has warned its final payouts could also be far larger; plaintiffs in Oregon alone have sought $8bn in damages.

The decline of the corporate’s inventory portfolio, which is accounted for in Berkshire’s revenue assertion, dragged down the general outcomes. The corporate registered a internet lack of $12.8bn, or $8,824 per class A share, in contrast with a $2.8bn internet loss a yr earlier than.

Buffett has lengthy characterised the web earnings figures as meaningless, saying the figures will be “extraordinarily deceptive to traders who’ve little or no data of accounting guidelines”.

[ad_2]