Underneath new boss Mohit Joshi, Tech Mahindra is drawing up an attention-grabbing progress story. However there are quite a few challenges

(Pictures: Hardik Chhabra)

MOHIT JOSHI

CEO & MD

Tech Mahindra

It’s nicely after 9 pm, and Mohit Joshi has had an extended day. His firm, Tech Mahindra, has simply declared its quarterly numbers, and he has a flight to Singapore the following day. Based mostly in London, Joshi is described by his employer as a “street warrior” and has a busy journey schedule worldwide.

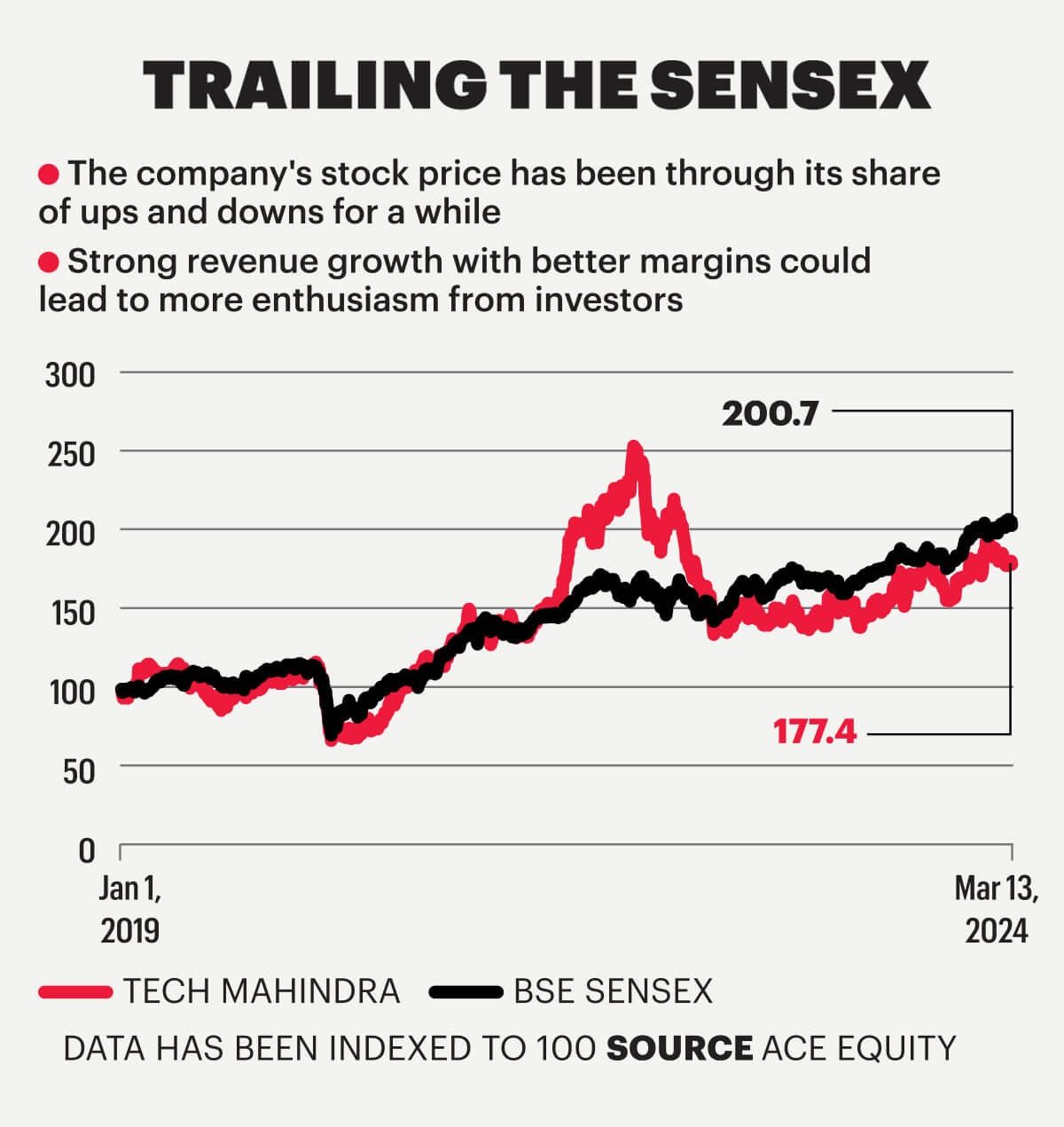

As he settles right into a lodge assembly room close to Mumbai’s worldwide airport for a working dinner, Joshi, the corporate’s CEO & MD, is chatty. He fields questions on challenges for the $6.5-billion Tech Mahindra, an IT providers and options firm that has been round for over three many years, and his optimism about synthetic intelligence (AI). He’s conscious about the benefit of being a part of a conglomerate and can use that strategically. On the similar time, there may be stress to extend margins to maintain up with its rivals. By any yardstick, these are troublesome occasions to be within the IT enterprise. However Tech Mahindra might discover them most attention-grabbing if it will get just a few issues proper and executes them nicely.

“ [While Gen AI will drive revenue growth] the numerous problem is making a specialised group and offering well timed deliverables for IT providers firms ”

Omkar Tanksale

Senior Analysis Analyst (IT)

Axis Securities

Transferring in

Joshi isn’t any stranger to spectacular progress. When he joined Infosys in late 2000, it was a $180-million firm; when he stop as President in mid-2023, its turnover was $18 billion. When Tech Mahindra’s provide got here, Joshi believed it was the appropriate measurement at $6.5 billion. “With 150,000 individuals, it was giant sufficient to have a world impression. It had a superb mixture of service strains, industries, and geographies,” says Joshi.

The soft-spoken Joshi, a historical past graduate with an MBA, performs down his recruitment as very easy. C.P. Gurnani was because of retire after 19 years at Tech Mahindra’s helm, and international govt search agency Spencer Stuart was mandated to search for candidates inside and outdoors the group. “There was a grand complete of two discussions earlier than I used to be picked. I appreciated the shopper base, expertise, and the group,” says Joshi.

He’s clear about guaranteeing continuity. “This isn’t a transition, and we didn’t have to come back in to rescue the corporate… The duty was to handle purchasers and chart a course for the place we wish to be two or three years from now,” Joshi explains. And he’s not speeding to construct his group (“90% is the outdated group,” he says). His playbook: construct a enterprise on sturdy fundamentals and get the most effective out of the group and model. Richard Lobo, the corporate’s Chief Individuals Officer, is evident that the change is merely part of the agency’s journey and that the workers have welcomed it.

“There may be deep expertise within the group and we wish to write the following chapter of Tech Mahindra,” says Joshi. Tech Mahindra was born as Mahindra British Telecom within the Nineteen Eighties, body-shopping for British Telecom earlier than graduating to the offshore mannequin. Its first milestone was the merger of Satyam Pc Providers with itself in 2012 after Satyam’s founder virtually sank the corporate with accounting jugglery and it was placed on the public sale block. The British Telecom hyperlink (which resulted in 2012) gave Tech Mahindra area management, whereas the Satyam acquisition catapulted it into the large league.

Making Measurement Work

Barring Tata Consultancy Providers, none of Tech Mahindra’s rivals has the benefit of being a part of a various group. Tech Mahindra is a part of the $21-billion Mahindra group, which makes automobiles, SUVs, and tractors and is concerned in monetary providers, logistics, actual property, and expertise providers, amongst different issues.

Joshi says Tech Mahindra’s power is its deep trade data, whether or not manufacturing cars, powertrains, or monetary providers. When individuals desire a manufacturing unit working on AI, Tech Mahindra can stroll into any Mahindra Powertrain manufacturing unit that makes engines and gearboxes or the factories making automobiles, SUVs, and vehicles and take a look at its theories.

Joshi factors out that the Mahindra manufacturing unit in Chakan, close to Pune in Maharashtra, is already sooner or later. “We present our abroad purchasers how expertise has been carried out. If it’s a use case in monetary providers, we will showcase Mahindra Finance,” he says.

“We eat our personal pet food, drink our personal champagne,” he says, citing Chakan. The group may transfer individuals round—say, an auto design professional from the auto enterprise to Tech Mahindra.

Siddhesh Mehta, a Analysis Analyst at Samco Securities, says Tech Mahindra can use its synergies to offer purchasers with complete options. He cites the connection between chip producers and automotive OEMs for instance. “It opens doorways to new markets and purchasers that Tech Mahindra could not have been in a position to entry independently. Plus, the advantage of shared R&D efforts results in quicker innovation and adoption of recent applied sciences,” he says.

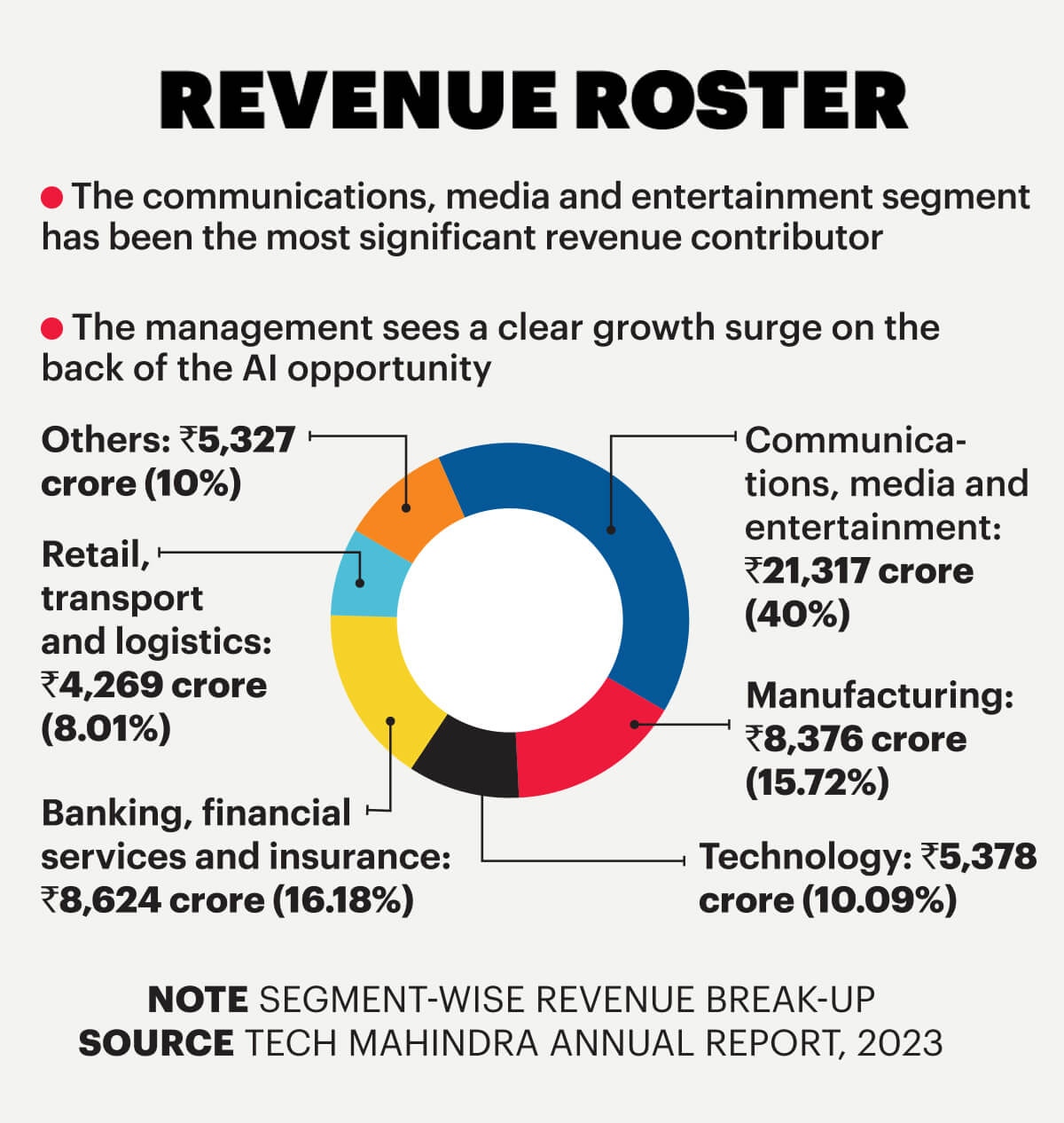

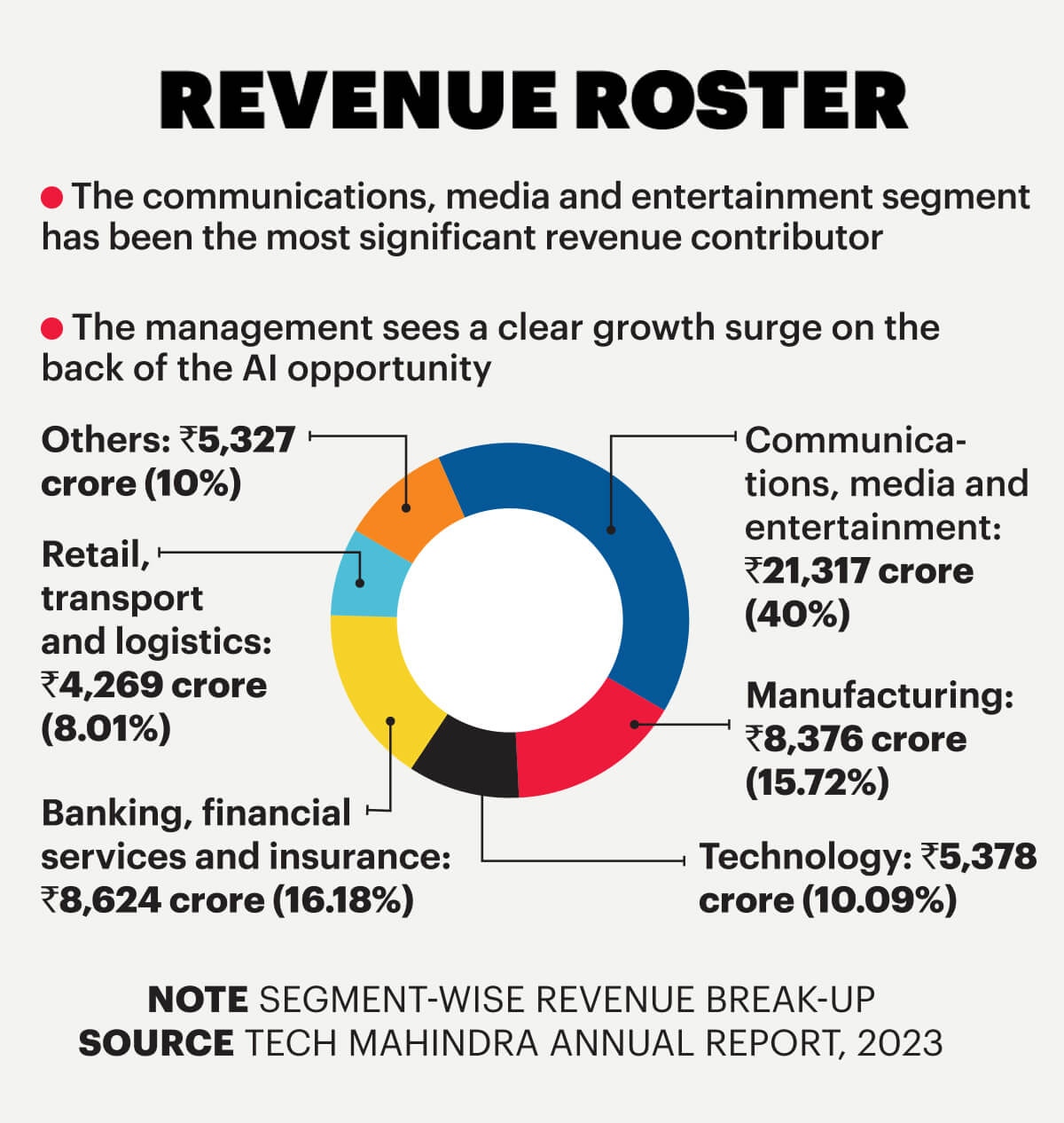

Communications, media, and leisure account for 40% (See graphic ‘Income Roster’), and it’s apparent why Joshi is so bullish about that phase and AI. “It’s nonetheless at an early stage, much like how electrical energy reworked the world within the 1800s. The chance is to know how companies will be reworked via AI,” he says. From his viewpoint, there are three use circumstances—contact centre transformation, expertise, and developer productiveness. The method is to first ask a shopper in, say, the telecom enterprise what’s being executed via transformation, which results in conversations with individuals constructing AI fashions other than doing it themselves. “It will be important for us to know the impression on our purchasers. On the finish of it, we’re an enterprise tech agency,” says Atul Soneja, the corporate’s COO.

“ Current efforts similar to lowering the variety of strategic enterprise models and eliminating low-potential areas point out a give attention to optimising sources and enhancing profitability ”

Siddhesh Mehta

Analysis Analyst

SAMCO Securities

Getting All the way down to Enterprise

The telecommunications dependence is substantial, as it’s “a really highly effective sector the place there may be engineering on the community with a B2C flavour as nicely”. Tech Mahindra’s historical past with British Telecom gave it a sound sector understanding.

Omkar Tanksale, Senior Analysis Analyst (IT) at Axis Securities, agrees that Tech Mahindra clearly “has valuation consolation” in contrast with friends like HCLTech, TCS and Infosys. “Nevertheless, its publicity to the telecom vertical, which has an unsure demand situation, is dragging its income progress momentum,” says Tanksale. “The challenges are exploring new progress areas and excessive publicity to the telecom vertical,” he says.

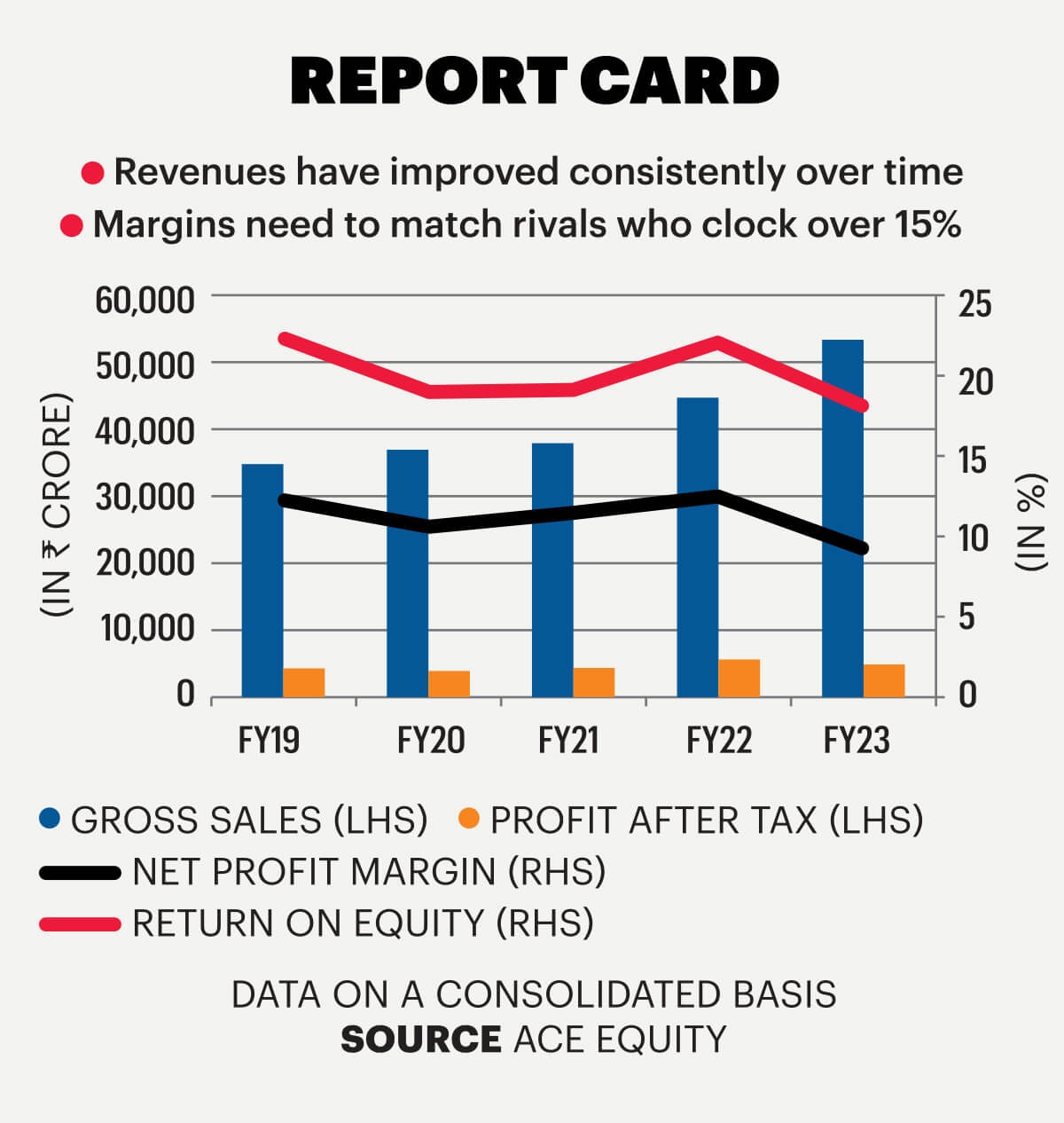

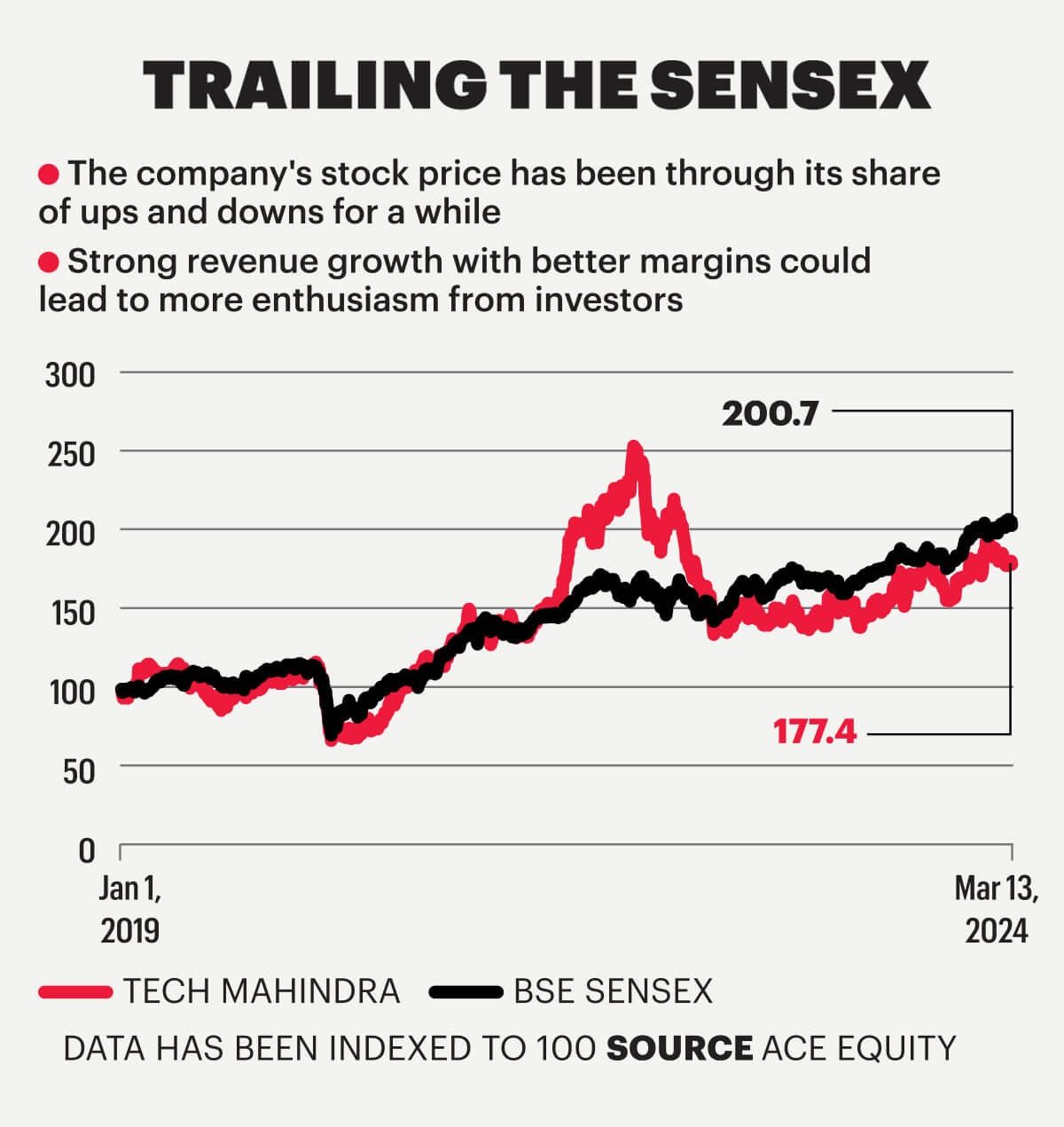

Concerning revenue margins, the litmus take a look at for a enterprise, Tech Mahindra has some technique to go. From FY19 to FY23, its web revenue margin was between 9% and 12.6%. The quantity for FY23 was 9.11%. Rivals similar to TCS reported 18-21% revenue margins, and Infosys reported 16-19%. A smaller participant like LTIMindtree has been reporting margins of over 15% for many of these 5 years.

That mentioned, Joshi factors out that there are a number of levers for margins. At an operational degree, it’s about excessive utilisation ranges. From a strategic viewpoint, it comes all the way down to pricing and pricing fashions. “There are extra parts like mental property; for this enterprise, we should be long-term grasping and make these investments,” he says.

In line with Mehta of Samco Securities, the corporate’s strategic initiatives and up to date give attention to bettering margins are steps in the appropriate path to strengthen its place within the Indian IT trade. “Current efforts similar to lowering the variety of strategic enterprise models (halved to 6 throughout Q3FY24) and eliminating low-potential areas point out a give attention to optimising sources and enhancing profitability,” he says.

Mehta says prioritising subcontracting, higher utilisation, and controlling overhead prices might assist. “The corporate is now focussed on prioritising contracts that yield increased revenue margins, which may have a direct and constructive impression,” he says.

Rohit Anand, Tech Mahindra’s CFO since November 2020, admits it’s impractical for Tech Mahindra to try to do the whole lot. “Sure, we should prioritise, and since we’re good at telecom, as an example, the method is to map alternatives. Capital is all the time restricted, and whereas it might be engaging to go for the income, it’s essential to steadiness risk-reward,” says Anand.

Change is underway at many ranges. One instance is the choice to usher in a CMO. Joshi introduced in Peeyush Dubey, who had labored at Infosys, Mindtree and LTI. “Crafting a strategic model narrative is vital coupled with advertising and marketing transferring to a advertising and marketing expertise position. With AI, ML, experiential design and the likes of influencers and analysts, we needed someone to anchor that ecosystem,” says Joshi. Prior to now, every enterprise had its advertising and marketing group until he determined to consolidate it.

Dubey says positioning a providers firm is troublesome. “That’s as a result of differentiation is a problem. For us, there may be the benefit of heritage plus very sturdy service strains upwards of $1 billion every,” he explains.

In line with Axis Securities’ Tanksale, demand for Gen AI shall be a income driver for Indian IT providers companies. “The problem is making a specialised group and offering well timed deliverables,” he says. Samco’s Mehta says, “The forward-thinking technique suits nicely with the anticipated rise in demand for customised, high-quality AI merchandise.” Citing Bloomberg Intelligence (which says the worldwide Gen AI market was price $40 billion in 2022), he says IT companies are growing a workforce able to turning discussions about AI into precise enterprise agreements. “Tech Mahindra stands out with its strategic initiatives like creating pre-built use circumstances in its Gen AI studio and devising an AI proficiency program to reinforce workers’ abilities.”

Challenges, Large and Small

When will Tech Mahindra be talked about in the identical breath as its rivals? “Tech Mahindra has by no means been managed with the tight operational self-discipline wanted for top efficiency and in a manner that successfully leverages its structural benefits,” says Peter Schumacher, Founder & CEO of Worth Management Group, a global administration consulting agency. The consequence, he explains, “was a misaligned working mannequin, an unfavourable income combine, unusually low margins, excessive prices, and weak pricing energy”.

Schumacher says Joshi is an efficient option to reboot Tech Mahindra. “He brings a wealth of expertise and has a transparent thought from his time at Infosys of what it takes to attain constantly superior efficiency ranges in a sizeable IT providers agency,” he says.

Joshi says the corporate’s three-year street map isn’t solely about engaged on a income plan. “We have to perceive how AI can rework sectors and the subsectors the place we wish to construct capabilities. We have to create a corporation recognized for area strengths and technological prowess,” he says.

Schumacher maintains it’s too early to say how a lot Gen AI will drive significant incremental income progress. “We consider that solely after Gen AI is embedded in enterprise processes and interwoven with different applied sciences will IT providers firms achieve a greater perspective of the chance spectrum and predict the demand,” he says.

Schumacher is evident that merely bettering working efficiency isn’t sufficient. “The transformation shall be profitable provided that Mohit and his group can institutionalise adjustments to construction and tradition, create new benefits and set up significant differentiation. Figuring out these new benefits and factors of distinction would require creativity and deep shopper insights,” he says.

Joshi factors out that enterprise is about being low on capex and large on hiring. “In case you see one thing promising, you possibly can pivot. To try this with software program is so much tougher,” he says. Tech Mahindra has myriad alternatives. It’s actually a query of the strategic items coming collectively. That may decide the contours of the corporate’s subsequent spherical of progress.

x

UI Developer : Pankaj Negi

Inventive Producer : Raj Verma

Movies : Mohsin Shaikh

Pictures: Hardik Chhabra

[ad_2]