Paytm Founder Vijay Shekhar Sharma is again within the trenches after RBI’s current motion left him and not using a banking platform. There are nonetheless some alternatives, however he must transfer swiftly to seize them

Vijay Shekhar Sharma’s digital funds journey has weathered many a storm over time. Now, the 46-year-old’s scenario is akin to rowing a ship continually springing leaks. Sharma fixes one gap, just for one other to spring up.

Let’s return a bit. Sharma’s One 97 Communications Ltd (OCL), based in 2000, pioneered using QR codes at service provider retailers a lot earlier than the demonetisation in 2016, giving its model, Paytm, a head begin. Quickly after QR codes grew to become in style, the federal government got here up with the Unified Funds Interface (UPI), sparking a revolution within the digital funds area. UPI levelled the enjoying discipline, and repair suppliers similar to Google Pay and PhonePe cornered a lion’s share of this. Whereas demonetisation did enhance funds companies, it grew to become clear that Paytm’s UPI enterprise was financially unviable due to the close to absence of the service provider low cost charge (MDR)—a payment {that a} service provider is charged for accepting funds.

“ We count on profitability to enhance, as a result of lots of the relationships we’ve with PPBL… are solvable

by means of third-party partnerships ”

MADHUR DEORA

President & Group CFO

Paytm, Throughout a name with traders

Sharma then diversified Paytm, which has SoftBank and Alibaba as traders, right into a mortgage distribution and funding merchandise agency, utilizing the funds insights of shoppers and retailers. Simply as issues started to normalise after Covid-19, regulatory scrutiny over Chinese language possession created uncertainty. Sharma rapidly decreased Alibaba affiliate Ant Financials’ stake and elevated his personal to 19.4%.

Then earlier this yr, OCL suffered a significant blow when the Reserve Financial institution of India (RBI) took motion towards its affiliate entity, Paytm Funds Financial institution Ltd (PPBL), for persistent non-compliance with KYC norms and different points. PPBL was barred from accepting recent deposits or top-ups in any buyer account, pay as you go devices, wallets, FASTags, and so forth., after March 15. Will Sharma have the ability to put Paytm again on monitor this time?

Some specialists like Barnik Chitran Maitra, Managing Accomplice of Arthur D. Little (ADL), India and South Asia, really feel that Sharma lacks focus. “He has not been in a position to scale up any enterprise to market management with a number of bets similar to Paytm Mall failing spectacularly. He must give attention to the one or two companies that he believes has the potential to scale and obtain market management,” says Maitra, including that there’s additionally the difficulty of credibility within the monetary sector. “He has to work exhausting to earn that belief again. The banking system operates on belief. Your mortgage companions must belief you, your mutual fund (MF) companions must belief you, and everybody within the ecosystem must belief you, notably regulator RBI.”

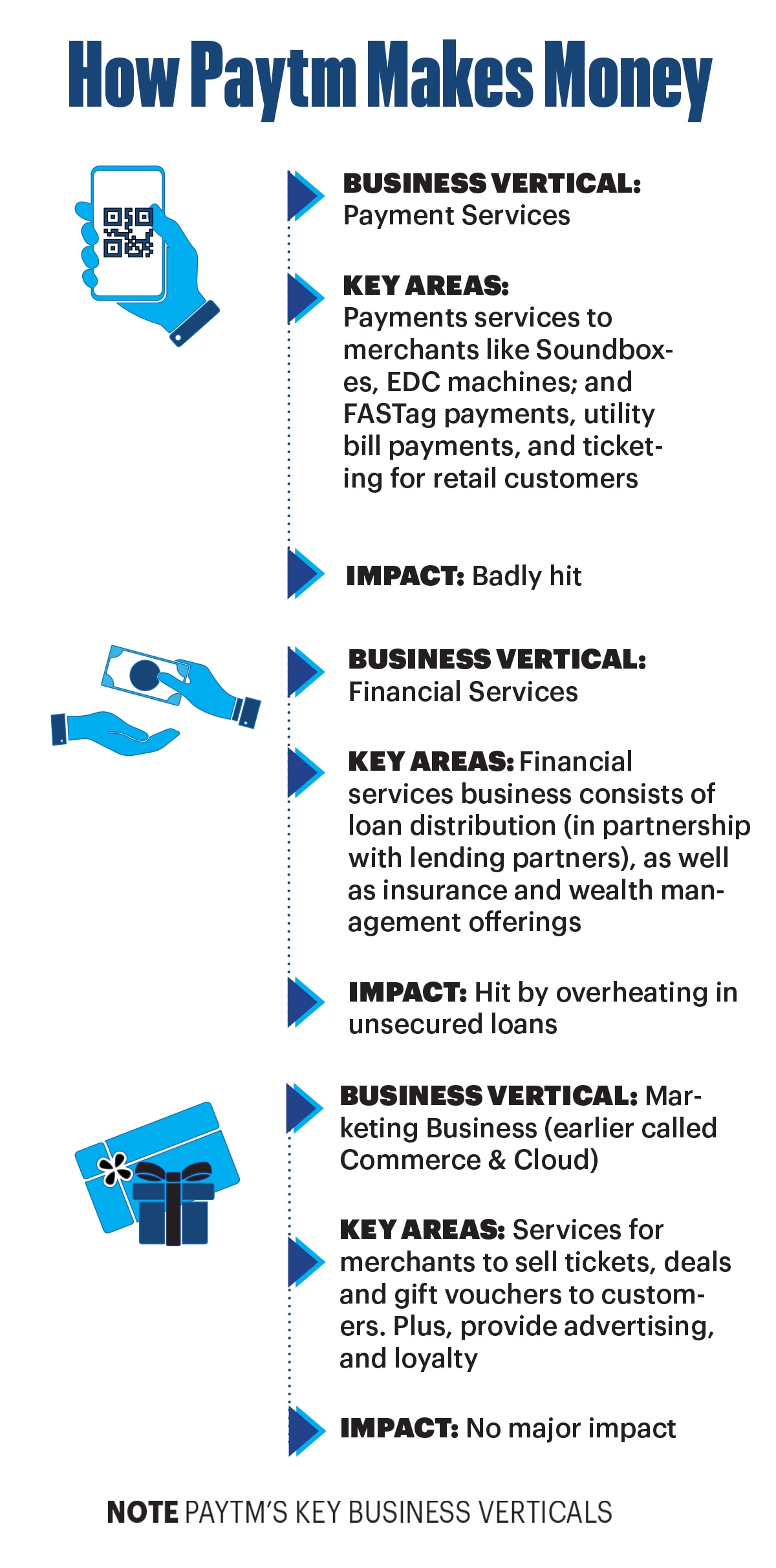

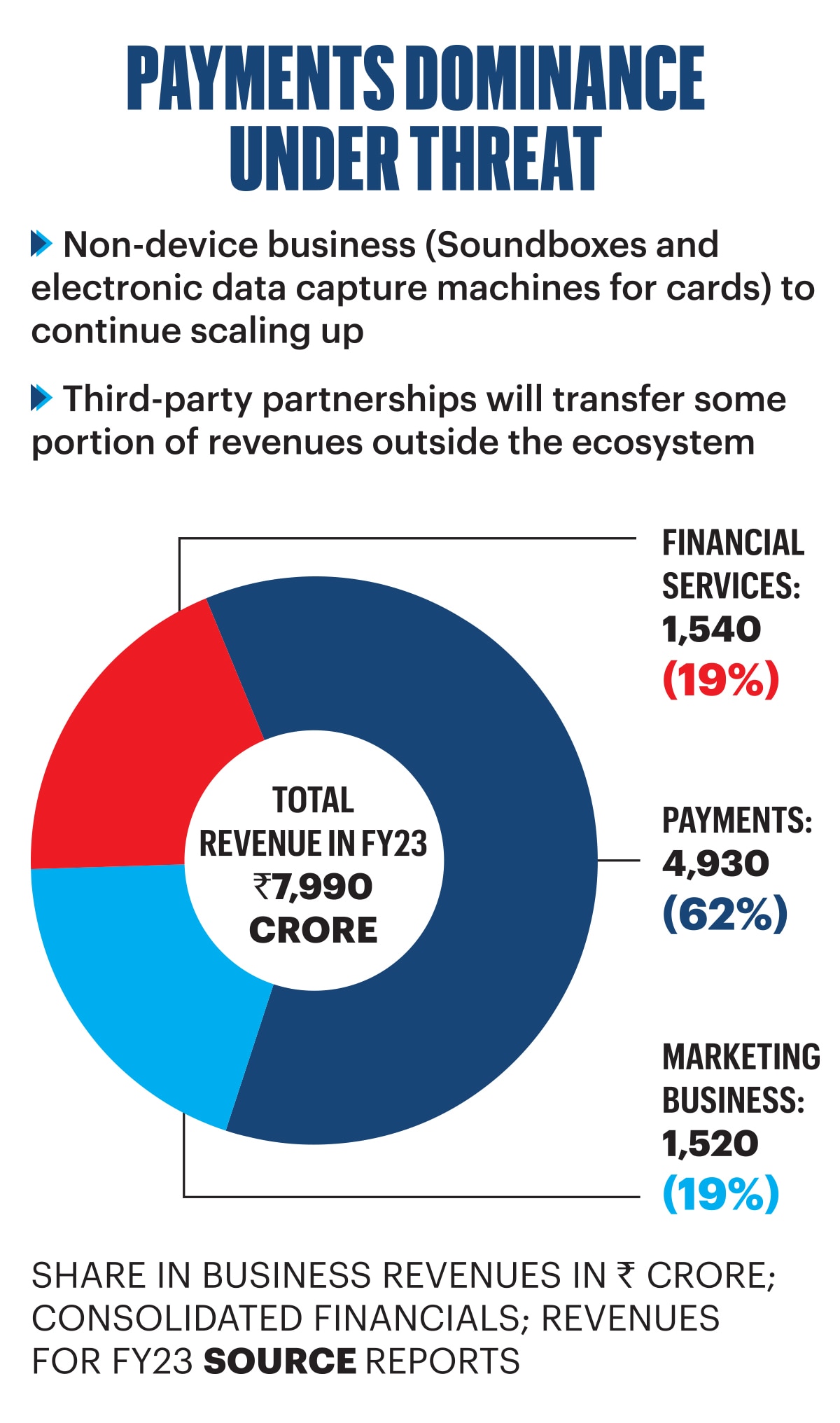

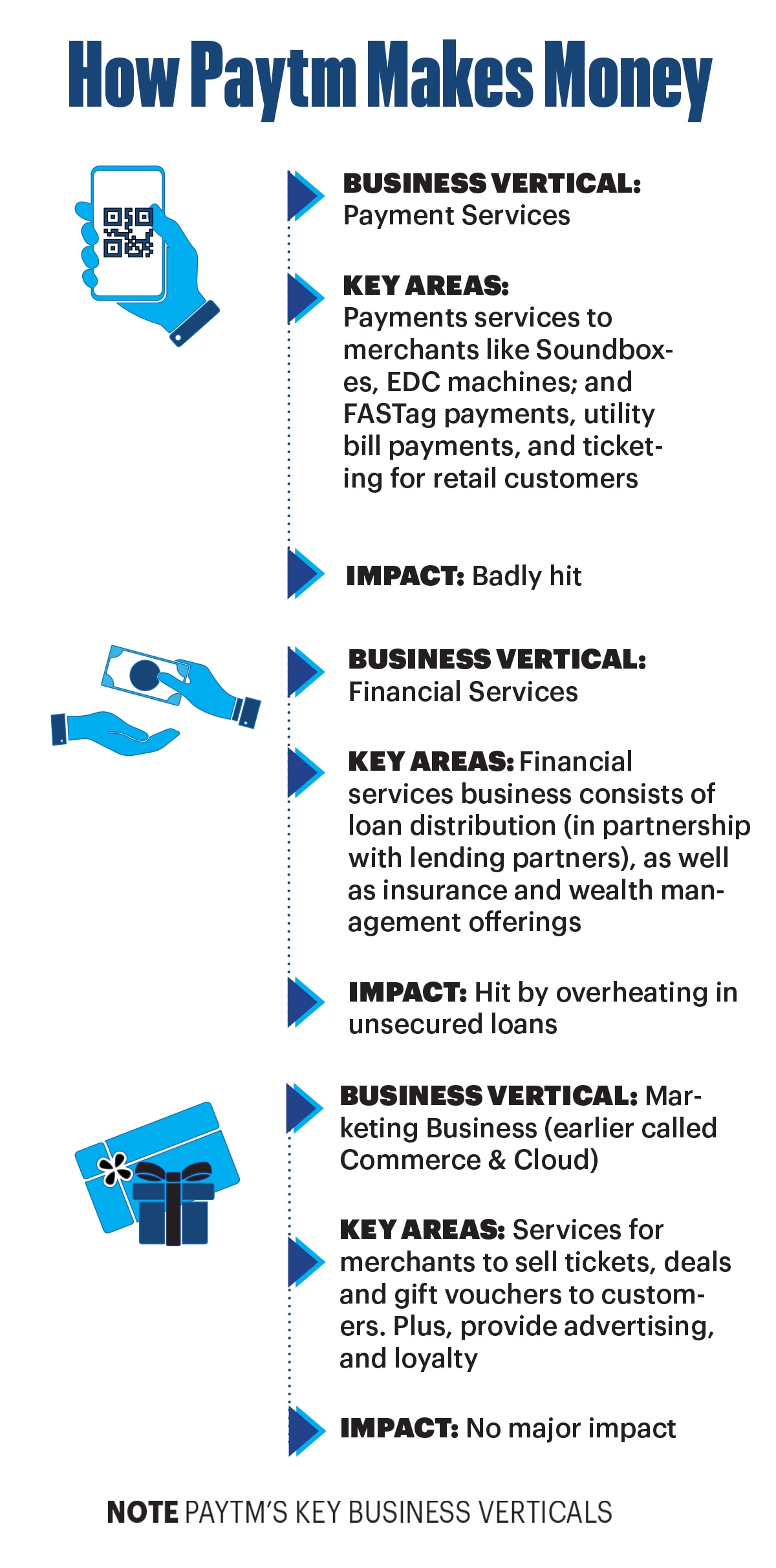

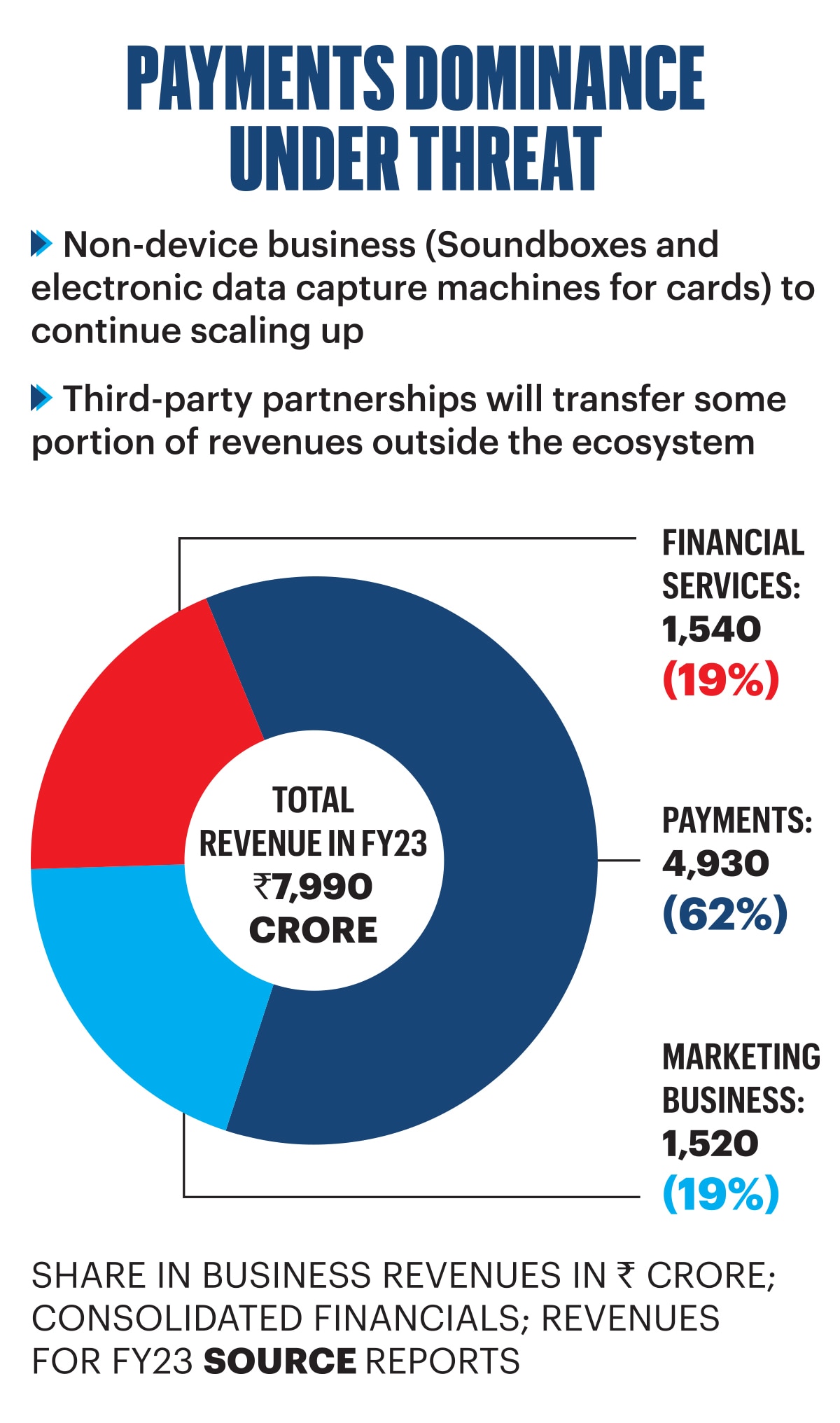

Paytm’s core focus is on buying prospects for funds (at the moment at 100 million-plus month-to-month transacting customers) and leveraging that information to construct a monetary providers enterprise. How has RBI’s motion affected Paytm, that has greater than three dozen subsidiaries and associates, and connects retail prospects and retailers? RBI’s strikes have impacted one in all Paytm’s three enterprise strains, specifically funds. (Monetary providers and advertising and marketing are its two different enterprise strains.) Revenues from funds, that make up greater than half its whole revenues, could expertise a success because of RBI’s restrictions. However Paytm insiders declare that minus fee gateway prices, the share of the three companies is one-third every.

Days after RBI’s transfer, Sharma termed the PPBL motion as “extra of an enormous velocity bump”. He assured traders that in partnership with different banks and the capabilities that Paytm had developed, the corporate will have the ability to get by means of. “And from right here on, we’re very clear that we are going to work with different banks… OCL has already been working with different banks for the previous two years,” he informed traders in a February name. Sharma declined to take part on this story due to Paytm’s silent interval—its FY24 outcomes can be out quickly.

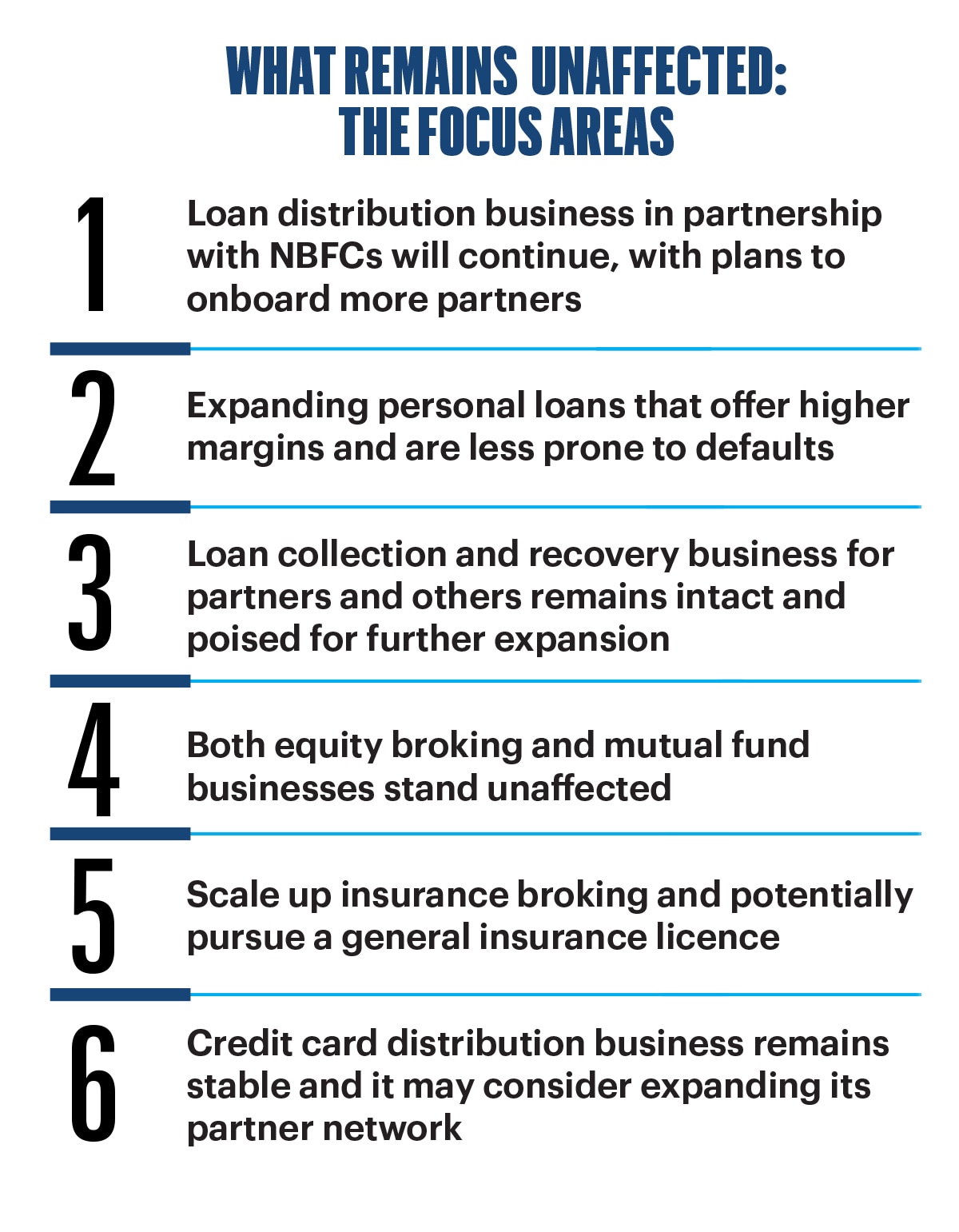

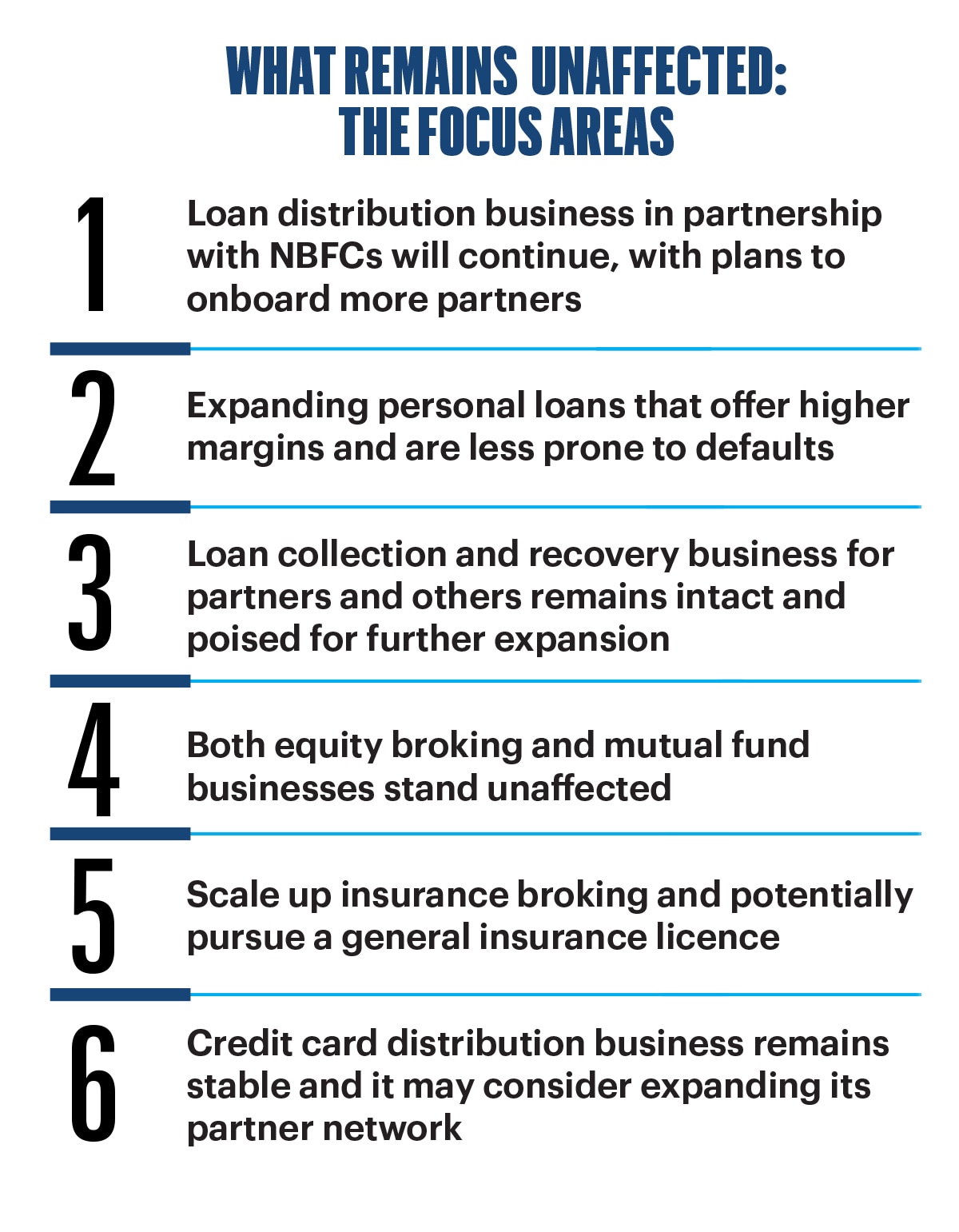

Again to Paytm. There are a number of companies inside its ecosystem. There may be an unsecured lending enterprise: purchase now, pay later (BNPL), service provider loans, private loans, and assortment & mortgage restoration providers. However progress is slowing because of overheating and the RBI’s rules, asking for larger capital allocation. The entry of Reliance Industries Ltd’s (RIL) Jio Monetary within the service provider funds market, notably its subscription-based gadget technique, is anticipated to compound Sharma’s troubles. Funds gamers like Google Pay and PhonePe even have plans to scale up monetary providers. To high all of it, RBI’s choice to permit banks to supply credit score strains on UPI at service provider retailers will allow main banks to encroach upon Sharma’s loans enterprise. Paytm additionally has a reduction broking enterprise on the fairness facet, akin to what Zerodha does, together with the distribution of MFs and insurance coverage. The third income line is the advertising and marketing enterprise, however that is still unaffected by the RBI motion.

“ [Sharma] must give attention to the one or two companies that he believes has the potential to scale and obtain market management ”

BARNIK CHITRAN MAITRA

Managing Accomplice

Arthur D. Little

India and South Asia

“Paytm has to determine the mannequin, and admittedly, understanding its document and DNA, it could have the person base, nevertheless it doesn’t have a product that can work as a result of everyone seems to be pleased utilizing PhonePe and Google Pay for funds, MakeMyTrip for travelling, BookMyShow for leisure, Zerodha for low cost brokerage, and Policybazaar for purchasing insurance policies,” says Kunal Nandwani, Co-founder and CEO at uTrade Options, an algo buying and selling agency. So the place does Paytm go from right here?

Altering Tides

Over the previous two years, Paytm has witnessed a big shift from UPI (non-MDR companies) in the direction of non-UPI companies within the funds vertical. “The rising demand for quicker and real-time funds throughout service provider segments opens up alternatives to rethink income methods past conventional MDR-centric enterprise fashions,” says Deepak Chand Thakur, Co-founder & CEO of NPST Ltd, a banking and fee providers supplier. Paytm is doing precisely that by directing its focus in the direction of medium- to giant retailers in want of fee units (similar to Soundbox or card processing machines, which yield larger GMV) to create a subscription-based income mannequin. Paytm has near 40 million retailers, 10.6 million subscription-based units put in, and modern devices like dynamic QR code, which seamlessly combine with the service provider’s billing system. Sharma is in search of a bigger slice of the non-UPI funds pie by means of the gadget technique to make sure the enterprise mannequin sustains. The third line of non-UPI revenues beneath funds is platform payment, collected from choose retailers or service suppliers utilising the Paytm app. Retail prospects additionally pay a platform payment to buy film tickets or guide leisure exhibits, in addition to for utilizing providers like invoice reminders and autopay.

Clearly, Sharma is on monitor to remodel a low-margin funds enterprise. However he faces two challenges. First, the gadget technique requires a discipline pressure and capital expenditure. Second, Jio has additionally commenced putting in its soundboxes at service provider retailers. “The service provider funds sector operates inside a scale-driven paradigm. In India, the buying panorama stays native and predominantly offline,” says Thakur. Sharma must construct the funds enterprise across the gadget technique, he provides. A giant profit is monetising retailers for loans and different monetary merchandise.

Caught within the Melee

Sharma stepped up his lending enterprise lengthy earlier than the PPBL restrictions had been put in place. Through the years, Paytm has onboarded eight lending companions, together with Tata Capital and Shriram Finance. Sharma typically calls it the 2×2 strategy: the mortgage quantity is lower than Rs 2 lakh and the tenor just isn’t greater than two years. The mannequin is easy—Paytm acts as a distributor and marketer of loans, providers loans, and does collections. The worth of loans originated for companions was Rs 15,535 crore within the Q3FY24. This enterprise is rising by 50%-plus YoY on a low base.

Paytm had paused the distribution of private loans for a number of days after the PPBL ban. This was as a result of its companions had been updating their danger committees, managements, or boards. “Sure elements, similar to service provider loans, require assurance that if a mortgage is given in the present day, the QR code will nonetheless be purposeful 45 days from now. Within the first half of March, RBI and varied financial institution companions offered the ultimate affirmation,” says an organization insider. In its current report, monetary providers main Macquarie raised the potential for lending companions reassessing their relationships with Paytm for mortgage origination after the PPBL affair. On high of that, previously 12 months or so, the unsecured loans market—notably for entry degree smaller ticket measurement loans to new-to-credit prospects—has seen larger stress. Paytm, with Paytm Postpaid, its product on this area—with a median ticket measurement of Rs 6,800—has been hit exhausting. “The BNPL enterprise has collapsed for all gamers because of RBI’s warning relating to consumption-related small-ticket loans,” says a market participant.

Deepak Chand Thakur

Co-founder & CEO

NPST Ltd

Paytm is aligning its insurance policies intently with RBI’s directives. Postpaid constitutes one-third of its volumes however yields considerably decrease margins in comparison with different mortgage merchandise. The corporate’s private loans enterprise relies on Postpaid, as these debtors graduate to the next restrict of as much as Rs 1 lakh after one yr. Paytm’s main focus is now on service provider loans and big-ticket loans. Service provider loans, the place the common ticket measurement has elevated to Rs 2 lakh, have a median tenure of 13 months. Sharma was fast to diversify the mortgage basket to longer maturities of 1 to 3 years. As its buyer base grew, Paytm shifted its strategy from attempting to find new prospects to farming current relationships. The larger ticket measurement loans are based mostly on whitelisted prospects who’ve some historical past of repayments and good credit score behaviour. Paytm can be eyeing banking companions, which typically provide greater ticket measurement loans.

Specialists say Paytm’s loans are concentrated within the dangerous unsecured area. In contrast to banks, which additionally deal in mortgages and automobile loans, Paytm has no diversification technique to save lots of itself from issues in a single section. “The largest problem is the power of Paytm to draw new lending companions to its community,” says an NBFC participant, who declined to be named. Some counsel that KYC and different compliance points will make the companions sceptical about associating themselves with Paytm. Jio’s entry into lending (presumably through free soundboxes) is one other problem, they add.

Diving for Pearls

Nevertheless, there are shiny spots. Lower than 5% of those that use the Paytm app use the mortgage facility, and this gives an enormous alternative. Then, Paytm provides 1-1.2 million units each quarter, and as soon as it has information for 6-12 months, its lending companions can begin providing loans based mostly on that information. Second, Paytm has until now supplied credit score amenities to only one-third of retailers who put in Soundboxes. Insiders say there are additionally discussions on diversifying into secured loans for lending companions. These could possibly be small property loans or auto loans, similar to for two-wheelers.

Then there’s Paytm’s funding enterprise—which contains fairness, MFs and wealth administration—and is but to see scale. On the fairness facet, Paytm operates as a reduction dealer, tapping alternatives within the F&O section and fairness buying and selling. Within the MF area, it prefers prospects creating extra SIPs. But it surely received’t be simple. Zerodha, Groww, Upstox, and Angel One management near two-thirds of the market within the broking area. In contrast to Paytm, Zerodha’s buyer base is aligned to cross-sell MFs or different inventory lending-related merchandise. “Paytm’s buyer base principally visits the web site for ticketing, reductions or to pay utility payments, and so forth. It will be a problem to promote them fairness, MFs, or insurance coverage,” says a market participant.

Presently, subsidiary Paytm Insurance coverage Broking operates as an insurance coverage aggregator. 4 years in the past, OCL determined to purchase 100% stake in Raheja QBE Normal Insurance coverage Firm. However the transaction couldn’t be accomplished. In April 2022, Paytm introduced its intention to enter common insurance coverage through the natural route with the corporate’s board approving Rs 950 crore in investments over the subsequent 10 years. However there hasn’t been a lot progress. “It is advisable to maintain a licence to create merchandise, somewhat than distribute, to earn annuity within the monetary providers business,” says an individual who runs an NBFC.

Within the insurance coverage aggregator area, there are market leaders similar to Policybazaar, Coverfox, and Easypolicy. Regardless of having the first-mover benefit, the 15-year-old PB Fintech—that owns Policybazaar—is lastly anticipated to report income in FY24, which speaks volumes in regards to the competitors and low margins on this area. As well as, there are insurtech or digital-only insurers like Acko and Digit, that are carving out a distinct segment within the digital area. Paytm will face vital challenges to scale and generate profits in these companies.

Paytm’s advertising and marketing providers enterprise (referred to as Commerce & Cloud earlier) is primarily about offering advertising and marketing options to its retailers, particularly model advertising and marketing, promoting, and loyalty providers. “This enterprise will seemingly witness minimal influence from the continued upheaval put up the current RBI restrictions,” states a report by brokerage Motilal Oswal. Retailers provide offers, present vouchers, reductions, coupons, ticketing, and so forth., and Paytm can promote these. On the commerce facet, it has journey, leisure and offers, and present vouchers. This enterprise will proceed to search for new use circumstances the place it permits totally different commerce providers for retailers on its app. The co-branded bank cards distribution enterprise for HDFC Financial institution, Kotak Mahindra Financial institution and SBI comes beneath the promoting vertical, and Paytm has acquired greater than 1 million customers for them. That’s 125% progress YoY.

The Manner Forward

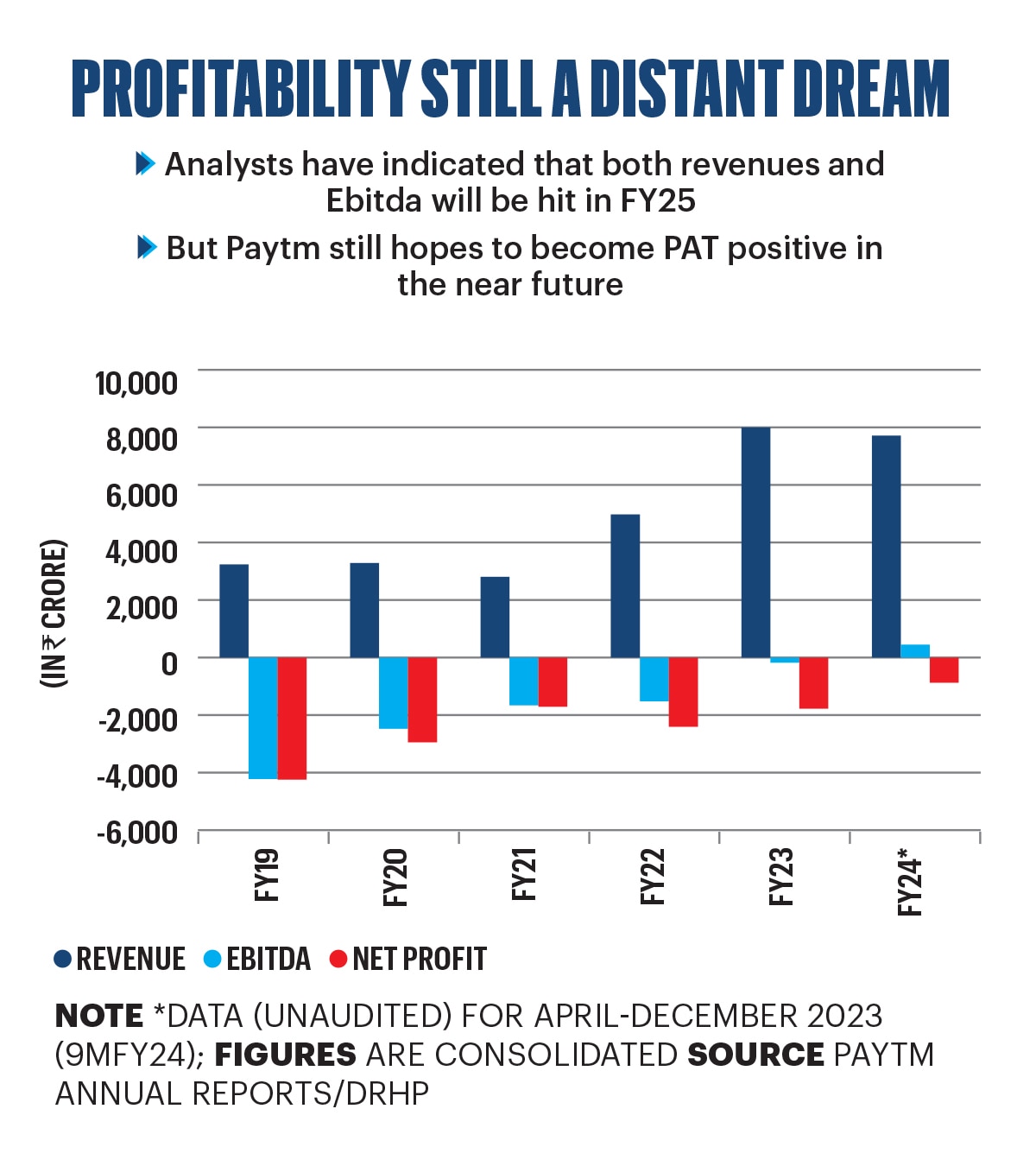

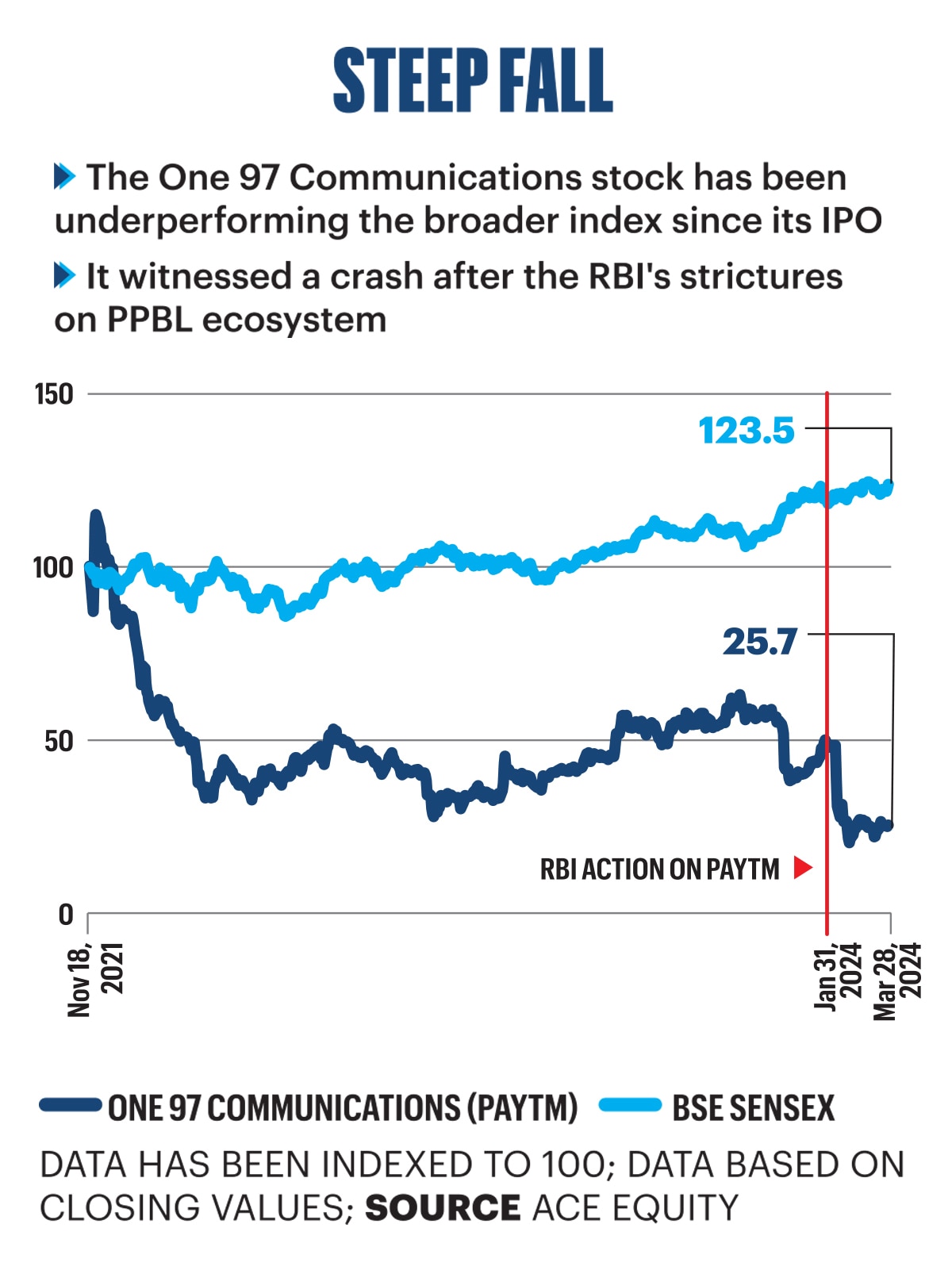

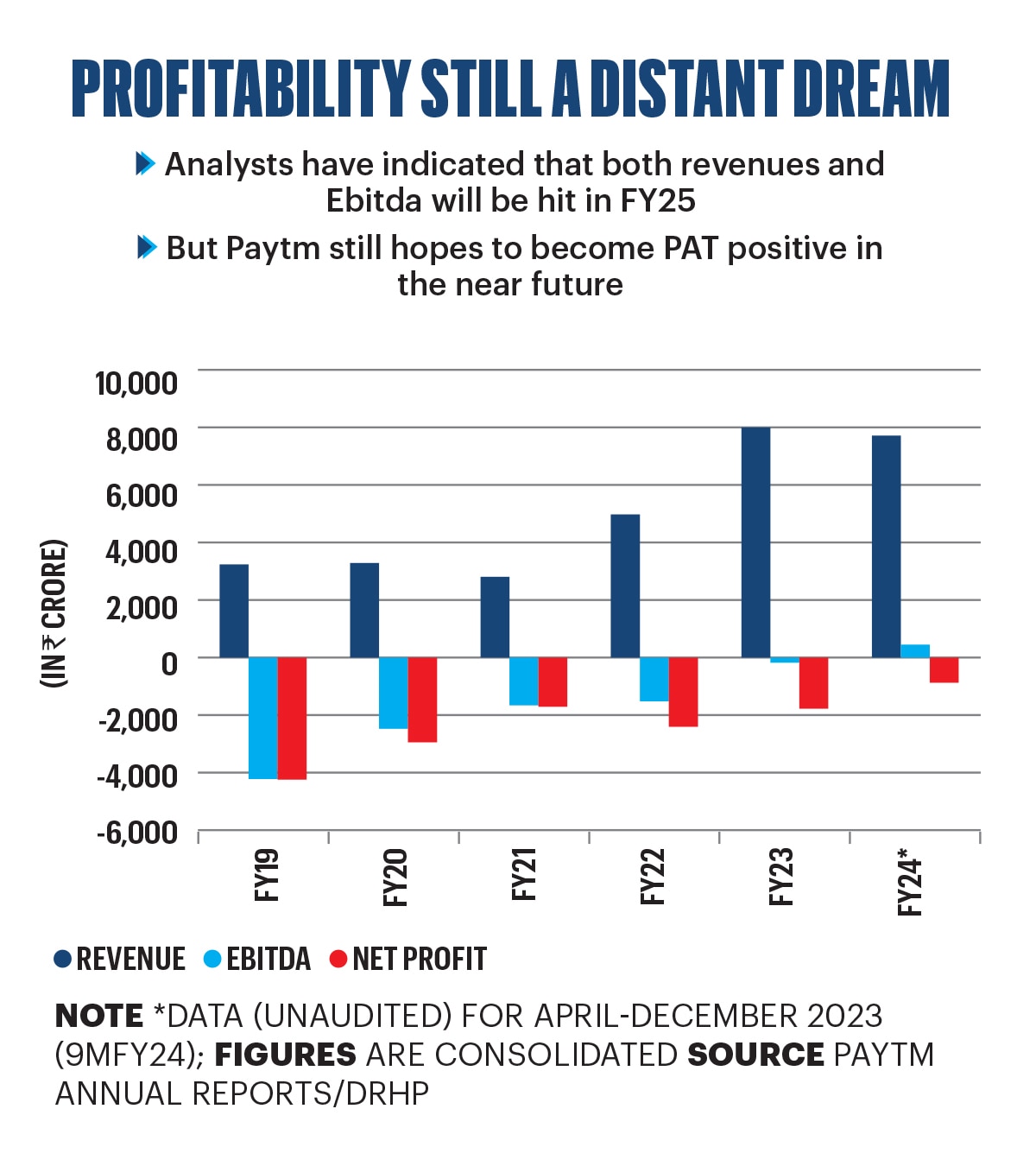

Earlier than RBI’s motion, Paytm was heading in the right direction to report web income within the close to future. Now, Motilal Oswal estimates fee revenues might decline by 27% in FY25, attributed to the decline in GMV, influence on pockets transactions, and loss in service provider and buyer base. “We challenge a 28% reduce in fee processing margin primarily because of decreased enterprise volumes and an antagonistic combine because the share of high-yielding pockets enterprise sharply declines,” it states in its report. International monetary providers agency UBS, in its February report, expects FY25 to be weak for Paytm. OCL, the holding firm, has already guided for a margin hit of Rs 300-500 crore on its annual Ebitda. However Madhur Deora, Paytm’s President and Group CFO, is optimistic. “Over time, we count on our profitability to maintain bettering, as a result of lots of the relationships that we’ve at the moment with PPBL, they’re all solvable by means of third-party partnerships,” he informed traders throughout a February name.

However, there can be a price. “We count on Paytm to extend its advertising and marketing spend to win again misplaced prospects, leading to elevated Ebitda losses in FY25, which drives our EPS cuts,” the UBS report says. Sharma must financial institution on higher-margin merchandise like greater ticket measurement private loans as their Ebitda contribution is considerably larger than postpaid loans. Paytm claims lending and promoting particularly contribute a big quantity of high-margin monetisation.

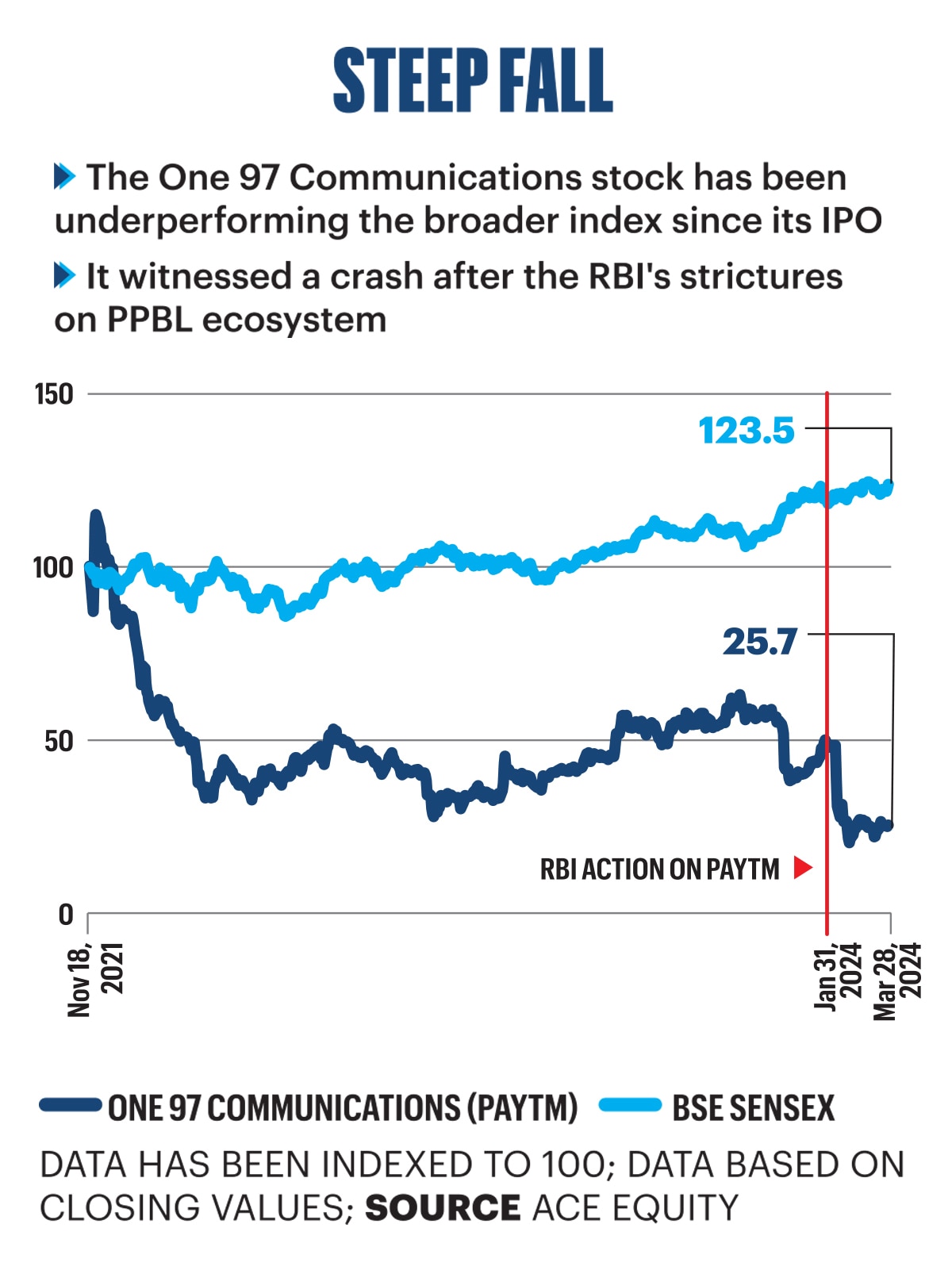

OCL’s inventory, buying and selling at Rs 412 a share with a market valuation of near Rs 26,200 crore as on April 8, 2024, has seen an enormous fall from its IPO value of Rs 2,150 a share. Traders can be watching Paytm’s capability to recuperate the misplaced enterprise on the earliest. Specialists say all of it appears good if Paytm has infinite cash. However being a publicly listed firm and the truth that its shares are actually priced at practically one-fifth of what they listed at, any fairness dilution would influence the market ratios.

Paytm seems to be notably susceptible as it might be troublesome to acquire licences from regulators for an NBFC, AMC and even insurance coverage agency, dashing Sharma’s hopes of proudly owning a financial institution. Maitra of ADL says Paytm’s worldwide traders could be pleased with a very good buyout or M&A provide, which permits them to seize some upside. “If I had been a smart non-public fairness or a enterprise capital investor in Paytm, I might welcome a consolidation with a strategic participant with deep pockets and the intent of investing within the progress of the enterprise,” he says.

The opposite possibility for Sharma is to go the entire hog as a platform firm because it already has a model. “They’ve the power to construct a brand new product or enterprise, however they’ll should fully reinvent themselves, which is a really exhausting factor as regulators, traders, and the market are towards it,” says uTrade’s Nandwani.

Sharma is focussing on innovation to take Paytm to the subsequent degree, betting massive on the ability of Gen AI. “We imagine that Paytm must change into a very AI firm,” he mentioned lately. At a expertise convention in Tokyo, his first public look after RBI’s motion, he emphasised the significance of taking cost of the scenario and enterprise initiative as an alternative of relying solely on teammates or advisors, acknowledging that they could not all the time have the proper understanding. As he works exhausting to repair the leaky boat, new challenges could emerge.

Whereas Paytm continues to chase new alternatives and recalibrate its technique, the quickly altering working surroundings will throw new curveballs. Sharma might take a leaf out of Jamie Dimon’s playbook. “I don’t know what is going to occur sooner or later, however what I give attention to is protecting JP Morgan actually robust and protecting my regulators pleased,” the CEO of JPMorgan Chase & Co. had mentioned.

Will Sharma have the ability to do a Dimon? Solely time will inform.

x

UI Developer: Pankaj Negi

Inventive Producer: Raj Verma

Movies: Mohsin Shaikh

Photographs & Illustration: Nilanjan Das

[ad_2]